What to expect from QPFP Professionals?

QPFP Professionals listed on this directory are one’s who have completed comprehensive education, cleared rigorous examination, have relevant experience and most importantly agree to abide by ethical conduct.

QPFP Professionals ultimate aim is to help public and their clients achieve holistic financial wellbeing covering all aspects of personal finances like savings, investments, insurance, taxes, loans, wills and more.

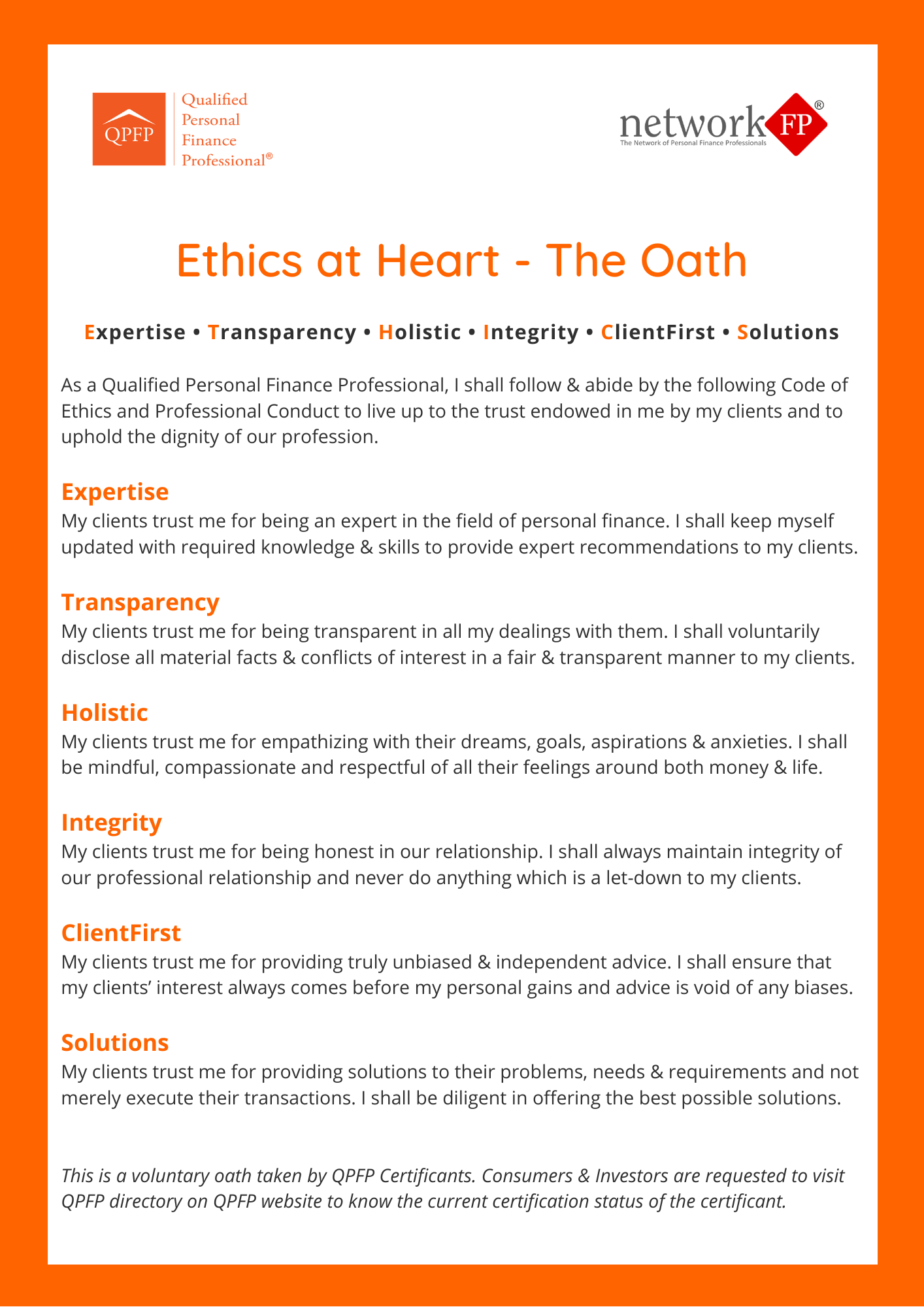

Here is the Ethics at Heart Oath taken by QPFP Professionals committing to developing Expertise, offering Transparency, having Holistic approach, serving with Integrity, always being ClientFirst & delivering need-based Solutions.

Who are QPFP Professionals?

QPFP Professionals meet high standards of Certification process before being awarded with QPFP Certification and getting listed on this directory.

Graduates

QPFPs have completed graduation as their base education.

Education

QPFPs complete a comprehensive 100 hour / 6 month program.

Experience

QPFPs have relevant experience in the personal finance space.

Ethics

QPFPs agree to abide by ethical code of professional conduct.

Continuous Education

QPFPs keeps themselves updated with continuous professional education.

Licensed

QPFPs have appropriate licenses to offer financial products / services.

How QPFP Professionals can help you?

QPFP Professionals provide various personal finance products and services. You may approach them for specific needs or comprehensive money & wealth management services.

Financial Solutions offered by QPFP Professionals

- Complete Financial Consultancy

- Retirement Consultancy

- Investment Consultancy

- Portfolio Review and Monitoring

- Complete Insurance Portfolio

- Children’s Future Consultancy

- Debt Management

- Tax Consultancy

- Loan Consultancy

- Wills & Trust Consultancy

Financial Products offered by QPFP Professionals

- Mutual Funds

- Direct Stocks

- Life Insurance

- Health Insurance

- Home Loans

- PMS / AIF

- Bonds

- Corporate Deposits

- P2P Investments

- International Investments

Choose Service / Product You Need

Frequently Asked Questions on

Working with a QPFP Professional

QPFP Professionals have knowledge of almost all financial products and solutions required by a family to manage their money well and meet their financial goals and investment objectives. They would understand your current situation and needs before giving any recommendations.

• To explore new opportunities that you never thought existed

• To protect, create and manage your wealth

• To help your family achieve financial well-being

• Opinion and guidance on pressing money matters

• To have a comprehensive look at your family finances

Anyone who wants professional help in managing their money, investments and insurances wisely should consider working with a QPFP Professional. Seek help of a professional if you are busy with work / life or lack inclination to do research and analysis or have made mistakes in the past.

Any activity requires specific skills to perform. The same applies to money management. If you're able to give your time, efforts to learn about it you can go for DIY. Or else 'Do it with a professional' is always a better option so that you're able to focus on your work / life and also make fewer mistakes in the journey.

1) Client-First Philosophy

2) Professional Qualifications

3) Range of Products / services offered

4) Remuneration method

5) Experience

Professionals get remunerated in the following two ways;

1) Commissions on Financial Products invested / bought through them.

2) Fees on Services / Solutions for which they may not be earning commissions.

Consumers are encouraged to check with professionals on mode of renumeration and ensure it's win-win for both of you.

Some Do's

1) Discuss complete information and data with your professional

2) Involve your spouse in money management process

3) Have a Long term orientation to products and investments

4) Ask right questions before buying / investing in any financial products

5) Take timely actions on recommendation provided by professionals

6) Chase your life's financial goals, instead on just high returns

Financial Wellbeing is a feeling of security and confidence about having enough financial resources to meet all your financial life goals (Needs, Wants, Dreams & Legacy). QPFP Professionals are trained to help families achieve financial wellbeing.

1) Investing without appropriate goals

2) Tagging wrong investments with the goals

3) Investing only based on past performances or in a hurry without researching much

4) Ignoring taxes and inflation.

5) Going DIY (Do It Yourself) without expertise, time commitment and interest.

QPFP Professionals usually follow these 6 steps while working with clients;

1) Understand client situation and needs

2) Analyse various products & solutions to meet needs

3) Recommend the best possible products & solutions

4) Execute the recommendations, fulfil transactions

5) Monitor the performance of products & investments

6) Coach the client till the financial goals are achieved

Free Resources for Public

Join free online courses and camps to get started on your journey to achieve complete financial wellbeing for your family.

31 Actions Course

Sign up for a free course – 31 Actions for Complete Financial Wellbeing. Delivered to your inbox daily for the next 31 days. Crisp, easy-to-understand and action-oriented tips which will help you to put financial house in order and take control of your family’s financial future.

Join Course NowFinancial Wellbeing Camp

Attend the free upcoming online camp on topics related to financial wellbeing, savings investments, insurance, taxes, loans and more. These are public awareness camps organised for general public and clients of Qualified Personal Finance Professionals.

Contact to Attend