Prepares you to do good for clients and earn well for self.

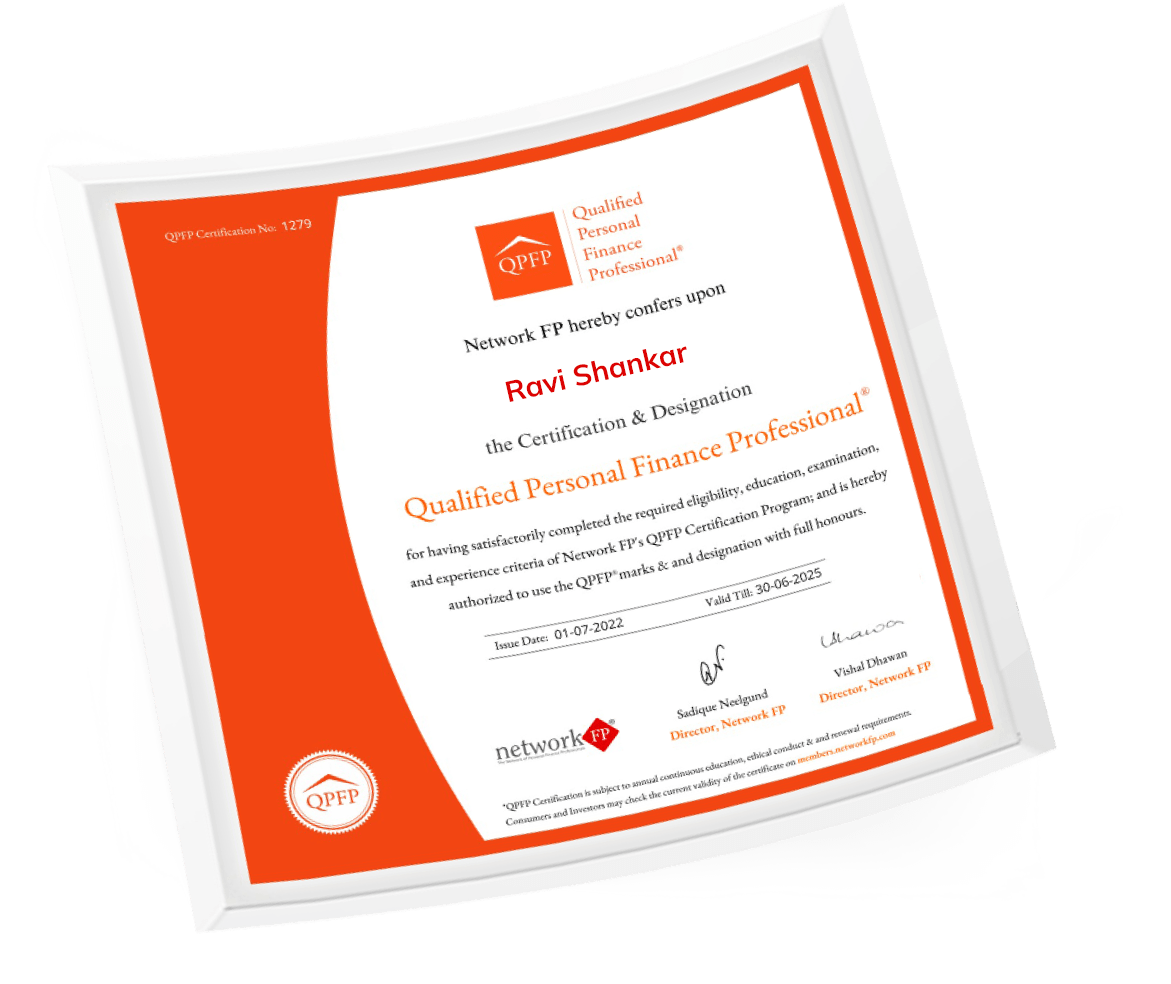

QPFP® is a 100% cohort-based online credential for existing and aspiring personal-finance professionals. Over six months, you'll learn from 30+ India's top practitioners and earn the right to use the "QPFP®" designation and logo.

Graduate + any one industry exam (NISM, IRDA, CFP®, CFA, etc.)

100+ hours of training spread across 6 months

1,000+ scenario-based questions, 3 level exams, 1 final mock & final exam

Weekly live sessions + on-demand recordings

30+ seasoned practitioners

Leveraging AI for smarter, faster, and more practical learning

Graduate + any one industry exam (NISM, IRDA, CFP®, CFA, etc.)

100+ hours of training spread across 6 months

1,000+ scenario-based questions, 3 level exams, 1 final mock & final exam

Weekly live sessions + on-demand recordings

30+ seasoned practitioners

Leveraging AI for smarter, faster, and more practical learning

Whether you are just starting out or looking to sharpen your practice, QPFP® gives you the knowledge, structure and confidence to succeed.

QPFP Program Curriculum has been very thoughtfully designed to deliver the practical learnings needed for professionals to solve real problems of investors/clients and deliver immense value.

The QPFP® curriculum comes with 50+ ready to use tools and templates designed to help you solve real - world client problems. From goal planning to product suitability, every ProTool helps you work faster, stay compliant and deliver optimum client value.

Attend live sessions every Saturday (9:30 AM–2 PM) or watch recordings same day. All content—PPTs, ProTools, tests—is accessible in your QPFP® portal.

Live & recorded

Calculators, templates, formats

Pledge to uphold client-first standards

Topic Tests, Level Exams, Mock & Final Exam

& Peer Forum for query solving

Live & recorded

Calculators, templates, formats

Pledge to uphold client-first standards

Topic Tests, Level Exams, Mock & Final Exam

& Peer Forum for query solving

First instalment of Application & Level I Fees is payable at the time of application. The remaining fees can be paid as you progress through the program.

₹16,000

₹16,000

₹16,000

₹16,000

₹64,000 (+ 18% GST)

ProMember Discount 50% off on Level I fees

Optional: XLFP Workshop ₹16,000

The program is designed step by step to make you a skilled personal finance professional. It takes six months to complete, with each stage being important.

Meet eligibility & apply

Sessions & Topic Tests

Sessions & Exams

Sessions & Exams

Applied Financial Planning Workshop

& Ethics@Heart Declaration

Certification & Directory Listing

Eligibility Criteria to apply for QPFP Program is:

The first installment toward the Application & Level 1 Fee is payable at the time of registration.

As the QPFP Certification program delivers immediate and ongoing value upon enrollment, we follow a strict no-refund & no-transfer policy

Applications are received till the cut-off date i.e 15 days before start of batch. Each batch has limited seats. In case the number of applications exceed seats available, we will close the applications.

All lecture recordings will be uploaded in student login portal given to you. The same would be available till the completion of your course.

The QPFP Program would run over 6 months.

A time commitment of 6-8 hours per week to attend sessions, take tests and submit assignments is good enough. However, each candidate may allocate more time as per his / her interest and availability to implement the learnings in real life.

Candidates get to watch all the recordings, take all tests and download all handouts and protools in their student login access.

Tests and Exams are held online. The final exam is also online but proctored. Candidates can take the exams within specified dates from the comfort of their home/office following examination rules and guidelines.

Topic Tests are of 10 minutes each. Level Exams are 2 hours each. Whereas the Final exam is for 4 hours.

Candidates need to score 60% or more to pass the exams. 25% negative marking is applicable in all Level and final exams.

Candidates attending the sessions regularly will easily be able to pass the examination with some additional effort. The program structure is designed to help sincere candidates clear exams without much stress. QPFP program focuses more on the ability of candidates to apply learnings in real life in a practical way rather than testing intelligence and analytical skills.

"*" indicates required fields