About QPFP Certification Program

QPFP Certification Program is a 100% cohort-based online program for existing and aspiring personal finance professionals like financial advisors, wealth managers, financial planners, insurance consultants, investment advisors, equity analysts, mutual fund distributors, etc. Candidates completing the program over 6 months are awarded prestigious QPFP Certification with a license to use the registered marks and designation of - Qualified Personal Finance Professional (QPFP)

QPFP Program Highlights

Eligibility to Apply

Graduate in any stream + Passed any one industry exam

Comprehensive Curriculum

50+ Topics and 50+ ProTools in 3 Levels

Top-Class Trainers & Coaches

Learn from 40+ India's Top Practitioners

100% Online Sessions

Attend weekly live or recordings as per your convenience

Tests & Exams

Attempt 1,000+ real life scenario based questions in Tests & Exams

Program Duration

Around 6 Months

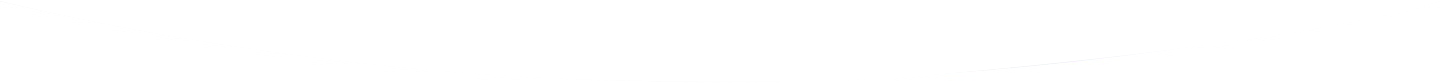

Who should join?

QPFP Certification Program is designed for both existing personal finance professionals (PFPs) and aspiring career aspirants. Anyone who wants to build a thriving career, want to go to the next level, do good for clients and earn well for themselves will find definitely a high-value from this program.

Established & Growing Personal Finance Professionals (PFPs)

should join to rebuild their career / practice for the new world in a new way. May also consider nominating their team members.

Beginner & Aspiring Personal Finance Professionals (PFPs)

should join to get super clarity, exact tools and required knowledge to build a thriving career / practice.

QPFP Program Curriculum

QPFP Program Curriculum has been very thoughtfully designed to deliver the practical learnings needed for professionals to solve real problems of investors/clients and deliver immense value.

- Topic 1 – Financial Consultancy Practice and Opportunities

- Topic 2 – My Ideal Practice Model and Career Growth Blueprint

- Topic 3 – Ethics, Responsibilities & Client First Approach

- Topic 4 – Four Pillars of Personal Finance & Behavioral Finance

- Topic 5 – Financial Maths & Time Value of Money – 1

- Topic 6 – Financial Maths & Rate of Return – 2

- Topic 7 – Investor Goals & Common Mistakes

- Topic 8 – Macro Economic Indicators Impacting Investors

- ProTool 1 – PFP Capability Analyzer

- ProTool 2 – Practice Indicators & Business Plan

- ProTool 3 – Ethics @ Heart – Self Analysis Tool

- ProTool 4 – Real Statement

- ProTool 5 -One TVM Calculator

- ProTool 6 – One ROR Calculator

- ProTool 7 – Clients Goal Matrix

- ProTool 8 – TVM & ROR – Practice Questions / MRPC Calculator

- Topic 9 – Organizing Financial Information & Documents

- Topic 10 – Wealth Management (without specific goals)

- Topic 11 – Risk Management & Life Insurance

- Topic 12 – Health & General Insurance Consultancy

- Topic 13 – House Purchase Consultancy

- Topic 14 – Child’s Higher Education Planning

- Topic 15 – Retirement Accumulation Consultancy

- Topic 16 – Retirement Distribution Consultancy

- Topic 17- Income Tax Consultancy

- Topic 18 – NRI Investments Consultancy

- Topic 19 – Wills & Succession Planning

- Topic 20 – Asset Classes & Asset Allocation Models

- ProTool 9 – Family FIDOK & Ratios

- ProTool 10 – Emergency Fund Calculator

- ProTool 11 – Risk Profiling Tool

- ProTool 12 – Complete Insurance Portfolio Builder

- ProTool 13 – Life Insurance Calculator

- ProTool 14 – Children’s Future Calculator

- ProTool 15 – House Purchase Calculator

- ProTool 16 – Retirement Accumulation Calculator

- ProTool 17 – Retirement Distribution Calculator

- ProTool 18 – Income Tax Calculator – Old & New

- ProTool 19 – One Page Financial Plan

- ProTool 20 – Will Template

- ProTool 21 – Asset Allocation & Assumptions

- Topic 21 – Life Insurance Products

- Topic 22 – Health & General Insurance Products

- Topic 23 – Employment Benefits & Govt. Schemes

- Topic 24 – Physical Investments (Real Estate & Gold)

- Topic 25 – Mutual Funds – Categories & Risks

- Topic 27 – Mutual Funds – Plans, Taxation, Costs

- Topic 28 – Equity Markets & Direct Equity

- Topic 29 – PMS & AIF

- Topic 30 – Debt Markets & Direct Debt

- Topic 31 – Other Investment – P2P, Smallcase, ETFs

- Topic 32 – Evaluation of Investment Products

- Topic 33 – Capital Gains Tax on Investments

- Topic 34 – International Investing

- Topic 35 – Other Investment Products – P2P, Passive etc

- Topic 36 – International Investing

- Topic 37 -Home Loan & Other Liabilities

- ProTool 22 – Life Insurance Comparision Template

- ProTool 23 – Health Insurance Comparision Template

- ProTool 24 – Employee Benefits Calculator – EPF, NPS, Gratuity

- ProTool 25 – Traditional Insurance v/s MF & Term Plan

- ProTool 26 – SIP Calculator

- ProTool 27 – SWP Calculator

- ProTool 28 – Product Suitability Matrix

- ProTool 29 – House Rent vs. Purchase Calculator

- ProTool 30 – SIP To Foreclose EMI on Home Loan

- ProTool 31 – Mutual Fund Whitelist Tracker – Equity

- ProTool 32 – Capital Gains Calculator

- ProTool 33 – Mutual Fund Whitelist Tracker – Debt

- ProTool 34 – Loan Amortization Calculator

- Data Gathering Sheet

- Current Financials

- Future Goals

- Live Cashflows

- Executive Summary

- Formatting & Customisation

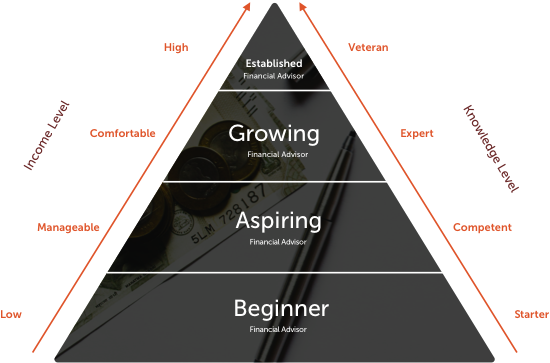

QPFP Education Delivery Model

QPFP Certification Program is delivered 100% online wherein sessions and exams can be attended virtually by candidates from the comfort of their home / office.

Attend Live Sessions

Sessions are live-streamed every week at a fixed day and time. Candidates have the option to attend the sessions live if the timings are comfortable for them.

Attend Recordings

Live sessions are recorded and uploaded immediately on the same day and can be accessed in the online login portal. Candidates can attend at per convenience.

What QPFP Candidates Get?

QPFP Certification Program is designed to deliver high-impact learnings. A 360-degree approach to professional education ensures the candidates get everything that is required to convert learnings into actions leading to career/practice growth.

100+ Hours Training

Get practical learnings directly from India's leading practitioners

50+ ProTools

Tools, templates, formats and calculators can be directly be used in practice / life immediately

1,000+ Questions

40+ Topic Tests,3 Level Exams, 2 Mock Exams and 1 Final Exam

Online Access Portal

Candidates can access recordings, PPTs, ProTools, etc. on NFP learning platform.

Query Solving

Get all your questions resolved by your peers, trainers or coaches or program manager

Coaching

Get help and handholding by your coach to guide you with implementation of learnings

What QPFP Certificants are Sayings:

Apply Now To Start Your Journey

Take the first step towards building a successful career / practice. QPFP Level 1 Fees i.e. 1st Instalment only payable at time of QPFP Application.

Follow 3 simple steps to apply for next batch:

- Step 1: Login/Signup on the NFP Learning Platform (Link below)

- Step 2: Click on QPFP Certification Application (In Register Menu)

- Step 3: Fill QPFP Application Form and pay for QPFP Level 1