December 21, 2021

3 Factors to consider while constructing an Asset Allocation framework

Dhaval Kapadia

Director, Portfolio Specialist Morningstar Investment Adviser India

Several studies have praised the virtues of asset allocation in driving portfolio performance over the long term. What’s less appreciated is that an asset allocation model is as good as the process followed to create it! An incorrect or inappropriately constructed asset allocation may not serve its intended purpose of generating superior risk-adjusted returns and helping investors achieve their financial goals. For instance, a portfolio that was overweight Indian small & mid-cap stocks in early 2018, after a period of extraordinary performance, would have witnessed steep drawdowns in the subsequent 2 years with these stocks correcting by over 50%! Similarly, a portfolio without allocation to international equities over the past 10 to 12 years would have underperformed and seen greater volatility in returns.

3 factors to consider while building asset allocation models for your advisor practice:

- Select asset classes with varied economic drivers

- Valuations do matter, even for long term investors &

- How often should one rebalance the portfolio?

Select asset classes with varied economic drivers

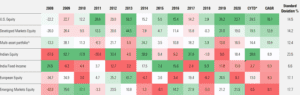

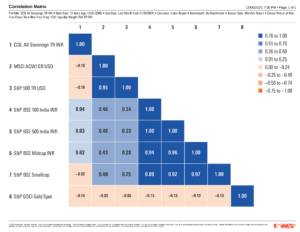

Each asset class has its own economic drivers or factors that drive its performance over the long term. For instance, Indian equities provide exposure to domestic economic growth drivers. If the Indian economy and corporates are doing well Indian stocks would generally do well and vice-versa. Fixed income provides a relatively secure cash flow and performs well in a softening interest rate scenario. Whereas cash benefits from rising rates. Global equities provide a larger opportunity set and foreign currency exposure. Due to varied economic drivers, the performance of each asset differs across market cycles. For instance, during 2013 & 2019 when Indian equities generated poor returns, international equities outperformed. Fixed income cushioned portfolios during periods of significant volatility including the GFC in 2008 and at the onset of the pandemic in early 2020. Selecting asset classes with varied economic drivers and low correlations vis-à-vis others, reduces volatility in portfolios and improves risk-adjusted returns.

Global winners and losers: The benefits of diversification

(Source: Morningstar Direct, in INR terms, *As of November 30, 2021. ^Composite index constituting S&P BSE 500 TR Index (40%) + MSCI ACWI (10%) + S&P GSCI Gol Spot (5%) + CCIL All Sovereign TR Index (45%) Other performance indexes used S&P BSE 500 TR Index, Morningstar Developed Market Index, Morningstar Emerging Market Index, Morningstar U.S. Market Index, Morningstar Europe Index, and CCIL All Sovereign Bond Index. This is for illustrative purposes only and not indicative of any investment. CAGR performance shown is from 2008 till date)

Correlation Matrix

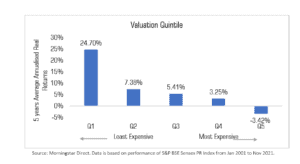

Valuations do matter, even for long-term investors!

Many advisors believe that portfolios constructed for long-term investors don’t need to change over time despite significant changes in asset class valuations. Chart 1 below depicts the 5-year average annualized real or inflation-adjusted returns from the Sensex since January 2001. The 5-year holding periods/observations are split into valuation quintiles with Q1 being the least expensive period and Q5 the most expensive period. The 5-year annualized return on investments made during Q1, i.e., the least expensive periods was 25%. As valuations at the time of investment increased, returns over the subsequent 5-year periods were lower. Investments made during the most expensive periods, i.e., Q5 generated a negative (-) 3.4% annualized return over the subsequent 5-year holding period. Clearly, investing in periods of relatively higher valuations has resulted in lower returns even with 5-year holding periods.

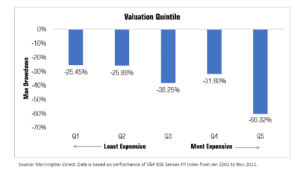

The flip side of investing is a risk. Here we measure risk in terms of maximum drawdown, which refers to the peak to trough fall in the value of the investment during its holding period. As valuations at the time of investment have risen, drawdowns have been steeper with a negative (-) 60% in Q5, the most expensive periods. In early 2008, Indian equities were trading at peak valuations prior to the Global Financial Crisis impacting markets globally resulting in domestic markets correcting by 60%. Investing in periods of high valuations has resulted in lower returns and higher risk for long-term investors.

How often should one rebalance the portfolio?

Rebalancing is a crucial area to consider once an asset allocation has been implemented in a client portfolio and over time market movements impact asset class weights resulting in a deviation from the original weights. Rebalancing may have cost and tax implications for investors hence it’s essential to weigh the pros and cons of rebalancing at a point in time. There are different ways of looking at the rebalancing decision, key among those are – i) rebalancing at pre-defined frequencies and ii) rebalancing based on asset class outlook.

i) Rebalancing at set frequencies, say every 6 to 12 months can build discipline into the process but may result unnecessary costs in case the drift or the difference between actual & target weights is small. One way to address this issue is to define ranges around the allocations, say +/- 3% from the target weight, and any drift outside the ranges can be considered for rebalancing. Of course, only addressing drifts would still leave the target allocations unchanged and exposed to market volatility particularly when valuations are high.

ii) Rebalancing based on asset class outlook involves making changes to allocations based on one’s views across various asset classes. Research points to the fact that expected returns for asset classes vary over time in ways that are predictable, creating opportunities for investors and their advisors to enhance returns. For instance, if one believes that Indian equities are overvalued, allocations to Indian equities would be reduced and re-invested in another asset class that looks relatively more attractive. A frequency to review the allocations can be determined, such as monthly, quarterly, etc. and rebalancing can be undertaken if there’s a change in view or risk-reward expectations. This way rebalancing costs can be better managed as there’s no pre-defined rebalancing frequency.

In conclusion, clients are investing to meet future goals and a sound asset allocation framework needs to be forward-looking, i.e. based on one’s expectations of how various asset classes would perform in the future and not just driven by past performance. Besides, it needs to be monitored and reviewed on an ongoing basis.

As Warren Buffett says, ‘Investing is simple but not easy.

Thanks for the writing such piece of article.

Solid data point & good composition of the words.

Thank you for the article. Very much informative and helpful