August 31, 2021

Potential Risk Class Matrix

Amit Trivedi

Owner, Karmayog Knowledge Academy

We all are aware of the two primary risks associated with debt mutual funds, viz., interest rate risk and credit risk. The fund managers embrace these risks in varying proportions in line with the investment objectives of the respective schemes. The goal is to take these risks in a calculated manner in order to enhance the portfolio returns, or sometimes avoid some risks in order to enhance the safety of the portfolio. It is at this stage that we need to understand the flexibility available with the fund manager to take risks. It would help if we know what the current level of risk is and this is where the risk-o-meter introduced by SEBI becomes handy.

However, one limitation of the risk-o-meter is that while it tells about the current level of liquidity, credit, and interest rate risks taken by the debt fund, it remains silent on what is the maximum risk that the respective debt fund can take. In the absence of such information, while an investor may be making a decision to invest on the basis of the current portfolio, the risk may go higher in the future.

In order to address this issue, SEBI issued a circular no. on June 7, 2021, SEBI/HO/IMD/IMD-II DOF3/P/CIR/2021/573, with a subject line: “Potential Risk Class Matrix for debt schemes based on Interest Rate Risk and Credit Risk”. Read the full circular here

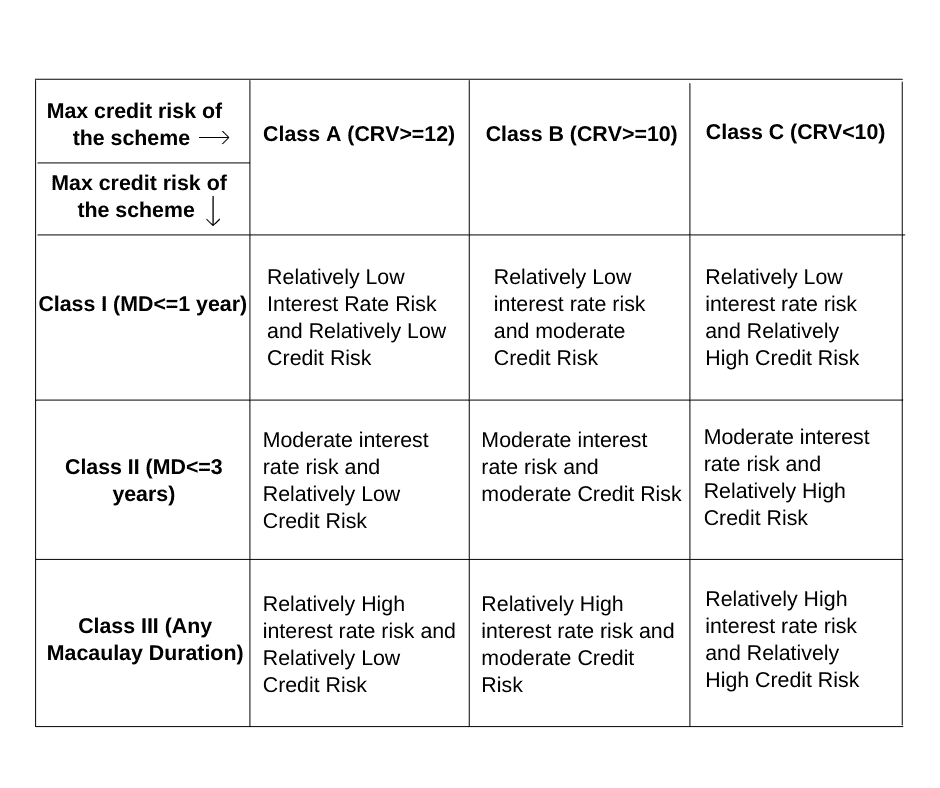

This circular introduced a very useful concept called Potential Risk Class Matrix for debt funds consisting of parameters based on maximum permissible interest rate risk and maximum permissible credit risk.

As per the SEBI circular, for the purpose of nomenclature, the 3 x 3 matrix shall have the following syntax for each matrix cell

CRV =Credit Risk Value, as defined by SEBI in the said circular

MD = Average Modified Duration of the portfolio

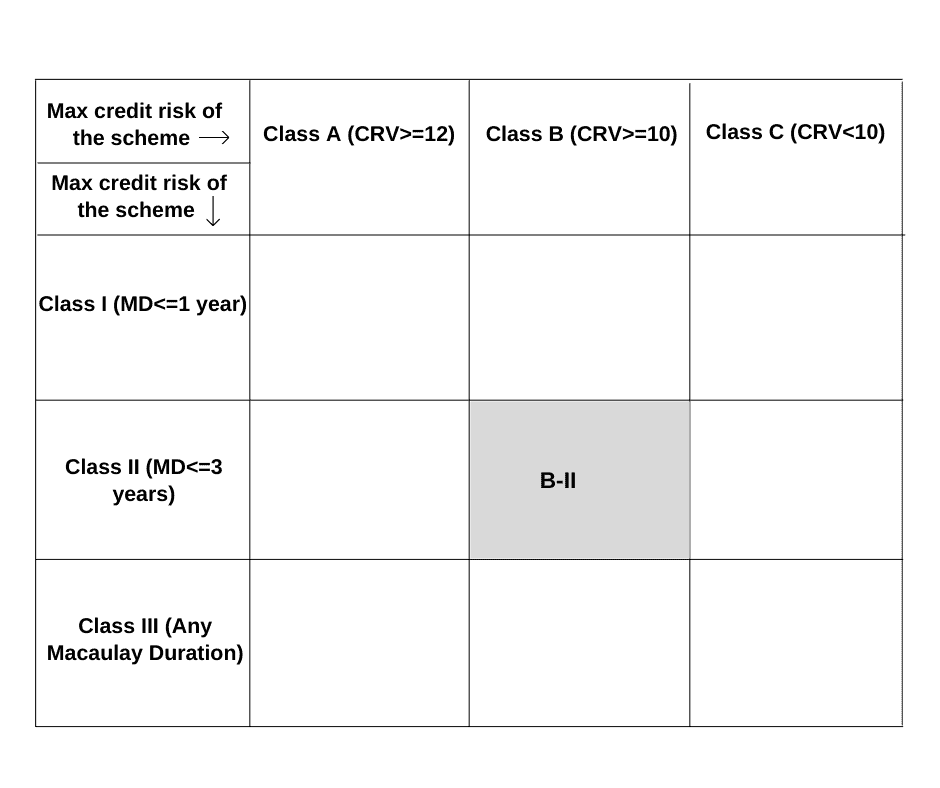

For example, if an open-ended Short Duration Fund wants to invest in securities such that its Weighted Average Macaulay Duration is less than or equal to 3 years and its Weighted Average Credit Risk Value is 10 or more, it would be classified as a scheme with ‘Moderate Interest Rate Risk and Moderate Credit Risk’. The position of the scheme in the matrix shall be displayed by the AMCs as under:

The maximum interest rate risk which the aforesaid scheme can take would be in terms of the Weighted Average Macaulay Duration of the scheme and the same shall be ≤ 3 years. The maximum Weighted Average Credit Risk which the aforesaid scheme can take would have a Credit Risk Value of 10 or more. Both the maximum interest rate risk and maximum credit risk would be reflected in the above matrix. By virtue of its placement in this position, the scheme would have the flexibility to take interest rate risk and credit risk below the maximum risk as stated above in Table 2.

The type of the scheme shall be modified to include the above cell selection. For the above example, it shall be as under:

An open-ended short-term debt scheme investing in instruments with a Macaulay duration between 1 year and 3 years. A moderate interest rate risk and moderate credit risk.

The benefit:

The investor/MFD/investment advisor clearly gains due to this change, as one would be able to make a better decision about how much risk one wants to take in the portfolio.

Leave a Reply