March 21, 2012

Chartered Accountants are not Financial Planners – Tell your clients/prospects

Sadique Neelgund

As I interact with a lot of investors, I find that some investors, particularly the HNI segment, have this habit of referring their Chartered Accountants (CA) for every financial decision including investments. I am not saying that this is completely a wrong practice, but one must also check that, is your Chartered Accountant so efficient that he can advice you on your investments or financial planning matters? By efficiency I am in no way referring to his qualification, but yes I am referring to his area of expertise.

I have seen that Chartered Accountants being given god-status in some households. Once I was with an aged investor and he was looking for tax efficient returns without any exposure to equity as this was an investment for around 6 months. The investor was into highest slab bracket hence I recommended him Fixed Maturity Plan from a reputed mutual fund house. But investor insisted that I should explain the product to his Chartered Accountant. Reluctantly (because of my past experiences) I agreed.

The first question that was asked by the CA was pretty basic- “is this an open-ended product or a close-ended product”. If an expert asks a question like this we all know the fate. He insisted investor to go for a Bank FD saying that the mutual funds are not safe and banks are. So invest in a PSU bank. And then he went for the final kill and suggested that since equity market is in bull phase, you should take 2-3 large cap stocks and sit tight. You will make the same money in one month that this FMP would give.

Although this Chartered Accountant had no vested interest and was working in favor of his client but his knowledge limitations ruined investors portfolio.

Chartered Accountant (CA) is not a Financial Advisor

Consider these following points before you refer to your Chartered Accountant (CA) for any of your investments decision or Financial Planning:

- CA is an expert in accounting and tax practices. He is not an expert on assets like Equity and Debt. Also he is not an expert on tracking or researching factors which are must for any investment decisions you take. These factors can be macro like European Crisis or micro like inflation. He may have view on these as a spectator but he is in no way qualified to analyze these facts to form an investment advice.

- In case of individual investor, a CAs job ceases after he calculates the amount of tax that investor needs to pay. Investments to save this tax fall under the purview of your Investment Advisor or your Financial Planner. He will help you invest a suitable tax saving instrument taking care of your overall portfolio, asset allocation and other needs.

- CA has no role in Financial Planning. He is not equipped to assist you in your goal planning or risk assessment. Also since he is not an asset expert he cannot help you in assessing your future finances and portfolio. CAs engaged into advising on investment just does it for the sake of not losing their clients or for some monetary gains. Beware as his advice will never be comprehensive.

- Your Financial Planner is expected to have detailed knowledge about economy and individual assets. He can also deal with tax related matters if you don’t have too complicated financial life. Also as he is associated with you since the early stages of investments, he has a broad picture of your individual requirements. He is aware of your family needs and you get personalized service.

- In some cases CAs act like product sellers for your insurance needs or tax savings bonds. This is not a correct practice in fact the Chartered Accountants are prohibited by their practice guidelines to act as commission agents. It is prudent that you take service of professional who is suited for the job. For all financial planning related aspects, your Financial Planner is most suited.

–

Roles of different Financial Professionals

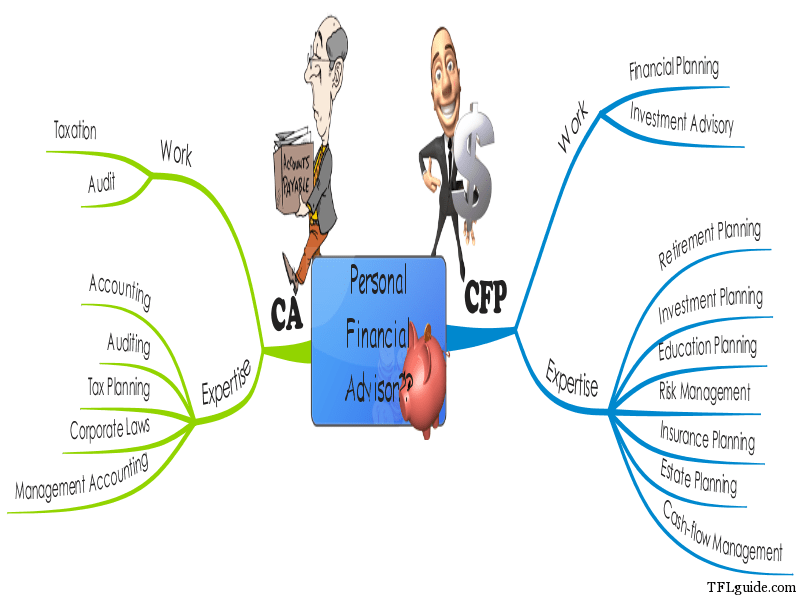

If we look at the roles or the expertise, Chartered Accountants are not Financial Planners or even Financial Advisors.

- Chartered Accountants (CA) work in fields of business and finance, including audit, taxation, financial and general management. (Refer Diagram)

- Financial Advisor is a professional who renders financial services including investment advice, which may include pension planning, advice on life insurance and other insurances such as income protection insurance, critical illness insurance etc., and advice on mortgages.

- Certified Financial Planner (CFP) is a practicing professional who helps people deal with various personal financial issues through proper planning, which includes: cash flow management, education planning, retirement planning, investment planning, risk management and insurance planning, tax planning, estate planning and business succession planning (for business owners).

–

So next time if you suffer prolonged common cold it is better to show this to a Doctor who is expert in Internal Medicine and not to a Cardiologist, even though the cardiologist is your friend and provides free advice over telephone. For god sake stop worshiping the wrong deity.

Must share your experience with Chartered Accountants for financial advice.

This is a article written by Hemant Beniwal on his consumer blog The Financial Literates.

*****

The Making of a Successful Financial Planner

One day Workshops by India’s top Financial Planners acros India

Earlybird Discount ends Friday, March 23

Ahmedabad I Delhi I Kolkata I Hyderabad I Chennai I Bangalore I Pune

To register, contact Priti Neelgund on 9892218582/priti@networkfp.com

Authored by,

So are Financial planners, they are not Chartered Accountants…in the end lets not forget client’s interest and who so ever serves the same, should be ok, irrespective of his professional designation.

Dislclaimer: I am a CA and a CFP so views might be biased to either of the qualification. Please don’t read this arguement in anticipation that one might turn out to be superior vs. other.

Now the map comparing CA and CFP seems ok from a theoritical perspective or for a student who is interested in pursuing further studies, but not to forget that qualifications are just the starting point for any person to have a basic understanding of things and then he may choose to practice or build his niche in any area.

To be frank, there are many qualified people (with or without degrees) who are doing well in terms of providing financial planning advise but at the same time there are N number of CFP’s who are not equipped to handle client’s financial planning due to lack of practical training. Atleast CA’s do get 3yrs mandatory training to learn the issues on the ground. Do you expect CFP to learn the techniques by experimenting on its clients?. You can always argue on concept of general medicine doctor vs. specialist but who knows the symptoms properly, may be the general medicine doctor fail to indentify your symptoms or may be the specialist choose to ignore it.

Well, the answer to any/all of the arguements should be that Client’s financial interest should be upholded and should be the prime consideration for determining whether a person is good or a bad client servicer. If the criteria is not met, it doesn’t really matter what qualfication you hold, you have breached your basic duty. This concept can be tested by principles like integrity or fiduciary duty or any other known ethical criteria out there.

So lets move on and focus on more important things in life, vs. just arguing who is better..

Hi Biharilal Deora,

I think you missed this in first para “By efficiency I am in no way referring to his qualification, but yes I am referring to his area of expertise.”

I wrote this article for consumers that are having misconception that their CA can take care of all financial matters.

Just to add – I have seen all type of CAs:

CAs who concentrate fully on their practice & are very successful.

CAs who are ready to do anything to earn additional income – insurance agency in name of his wife, selling plots etc

CAs who had left their profession & 100% transformed themselves as financial advisor.

I fully agree with hemant as we are not referring to his qualification but area of expertise. I have seen also many CAs who do not know even mutual fund investments. Basically CA’s curriculum is concentrated on the legal matters, book keeping(Dr Cr) and corporate tax matters not individual tax and financial planning matters. The article demystifies the misconception in the mind of every lay investor , does not get personal attack on CAs . Their curriculum itself does not justify as financial planner, how could a layman rely on CAs for his financial matters.

Hey,

Some of the examples given above about CA V/S CFP were quiet unnecessary.

We should respect each others professions and not to be too childish who is best and who is worst and we are not here for battling for supremacy. We should keep our egos and other conflict elements away and try help the clients ultimately. Our survival or success or failures depends on how we care about ourselves every time whenever or wherever we are and we may represent as in Insurance agent,MF, Bank RMs and Financial planners.

True integrity may be revealed when we are doing any kind of activities without hurting others financially or any other way may lead towards success. He need not have to prove anyone whether it is worth carrying those qualifications.

Let us bring revolution in ourselves as human beings in our daily activities though there are family,economic and societal pressures, we tend to deviate from our selves. Again i am not here to teach or demotivate any one its upto us to take it seriously and pursue it for betterment .

Specializations may help us to be more efficient but denies true intelligence.

Folks dont be so serious about qualifications but lets get out there do our best whichever field one may belong to. Learn from each other and we cant carry everything and we have to leave everything while pass every day.

Lets take it in right spirit. Move on.

Thanks

Badarish

Thus far CAs ruled the financial domain. They are reluctant to cede this space to other professionals. Hence, they always try to show their ‘superiority’ to justify their ‘fee’ to their clients.

Like in your story, the client will sooner or later realise what he/she has done and will get back to professional CFPs for advice on their financial future. You may have lost the battle, but you will win the war.

I agree with both of above Mr. B.D. and Mr. Manish Jain. I come around with many CFP who cleared the exam just by clicking the button and who are interested in mostly Mutual Fund. You may find deeply, mostly mutual fund industry back CFP not insurnace. Slowly situation is on change. I want to say many are mostly interested in one of the segment of Financial Planning. And even more, want to sell products on the basis of CFP logo.

Many EP are alluring very young people promising to have a job in one of the sponsors. Though CFP SYLLABUS is not a big thing, its practical approach is the main thing. Immaturity of CFP will place CFP in bad shape.

On the other hand CA are in better position to understand the concept of FP very easily. Practicing both CA and CFP will be somewhat difficult for CA. Why? Because, CA is a hard practice, governed by rules, laws. CA would say client regarding rule, client would do accordingly without much question. CFP is not governed by rules. It is ruled by plan and emotions.

For CA, to take care of hardness and emotions side by side, would be really difficult.

I am accountant (not CA) by profession. I come to know one CA who takes fee of Rs.30000.00 for audit of pvt ltd. company for not more than 3-4 days work. Most work was done by his article. Not much legal complexities is there. That CA is earning Rs. 75000.00 per year on various services. I am talking about Ahmedabad Area.

Here CA is fulfilling legal requirement of a client, so he can ask such a high charge bullying him. He has not to show his performance. He has to take care of deadlines of various department and non or very less intruption from the deparement. He has not to show performance with client money.

So,In my opinion, CA are in much better position in grasping the syllabus of CFP, will not be good practioner.

Still CA are welcome to the community of CFP.

Hi Nayan,

You have highlighted a good point here “CA is fulfilling legal requirement of a client” – something similar to buying vehicle insurance vs buying term plan.

Hi Manish,

I fully agree with you but for the game of superiority – clients have to pay a heavy price.

I believe tie ups between C.A.s and financial planners make gr8 business sense

I really agree with Himanshu.

Partha Sarathi Datta on Facebook

Completely agree, but CA can double as FP, if he/she learns the game and practices the same.

As a designation- it is really double. But I really doubt that it will be easy to practice both segment. They may damage to Financial Planning Industry.

Thanks Sadique for sharing this article here.

Dear Hemanthji,

Thank you for a brilliant article on this core subject- and coming from the client side of business, i completely agree with your assessment and also could relate to your experiences..

the situation becomes even more complex and difficult when the CA in question also have vested interests- like a agency on his name or proxy names- and then its almost impossible to get around this and talk of parallel things to the client.. but then, i feel its more of a case of domain capture like what manish has pointed out.. thy have been into this domain for a long period of time and its not easy for CFP’s and Planners to enter this space without consistent delivery or exclusive positioning.

Client preferences still remain the key and we need to find a way to address it. I strongly believe that our positioning and business concept should be strong enough to convince the client and also worthy enough for his to shift the mind set.

Thank you himanshu for that powerful thought- which i feel is the most potent business plan if we can implement it- mutual co operation between CA’s & CFP’s indeed makes a lot of sense and complement each other.

Bottom line- What we have to offer and how we offer it – is the key to client acquisition .

We have chartered accountant as our financial planning client….when he was a prospect he said I am a CA I know most of the things I said fine than why did you approach me lets talk that and he became a client

Hi Nandish,

Even I am having CA as my client – when we first interacted he was so sure about his finances but when we collected data he was in debt trap.

That is awesome that you could help him see that he is in a mess. Our work can benefit anyone who is willing to take help

Many time ego really play bad roll. Someone who are considered superior presently in society are mostly in bad shape. I have seen many doctors who now and then churn their portfolio and believe that they are doing something good to their finance.

I want to come to the point that superiority in some field does not mean that they can be superior at finance.

Frankly, as of today, both the CAs as well as the CFPs sorely lack in skills when it comes to Investment Advisory, and in some cases even Insurance Advisory. The reasons for that are different:

CAs are not trained at all in the aspects of Investment Analysis and Insurance Planning. It’s only after the recent changes in syllabus that CAs need to study Financial Management in considerable depth, and that too, primarily keeping in mind the needs of a corporate set-up, and not of an individual.

As far as CFPs are concerned, though theoretically they learn all the concepts of Investment and Insurance, and are best placed to conduct a practice aimed at advising individuals, many of the fresh CFPs lack the in-depth understanding of Investment and Insurance Product (unless they’ve been distributing them even before they became CFPs), and that understanding comes only with experience of actually getting their hands dirty in advisory practice. The quality of advisory service given by CFPs varies greatly from one practitioner to another.

As of today, if CAs realise that individual financial planning practice is lucrative, ICAI (which is known to vociferously guard whatever it thinks is its territory) would take great pains to conduct post qualification courses and other initiatives for them to get them up to speed in financial planning concepts. As of today, thus, CAs are sleeping giants, who may swing into action, as soon as financial planning field matures in India, IMHO.

Disclosure: I am a CFP and an aspiring CA.

Lets not cry about the fact that the territory of financial planning is govened by whom or who is not ready to vacate space. At the end its about quality and if as a CA or a CFP or MBA or for that matter XYZ, If you can offer quality, why afraid of competetion?

Lets rule the market on our values, Ethics and client interest, how does it matter, what client thinks. Clients have burnt hands with all sorts of fancy qualifications including the one’s discussed here so lets not use just the degree to say that we are better vs. rest or vice versa. Lets prove/show the value to the client himself so that he understands the differece.

By the way, there are practicising CFP’s also whose majority of the income comes from an agent role vs. advisor. At the end, only when the tide goes away, you would know who was swimming naked…

Hi Biharila Deora,

Why you are taking things personally – no body is crying here.

When we say “Politicians are Corrupt” does that mean 100% politicians are corrupt. Similarly “Chartered Accountants are not Financial Planners” is a generic statement.

I could take things personally on both sides if i want to since i am a CFP as well Haha.

Anyway, the only point i want o make here is about people complaining how they are not getting their fair share because of some other qualification or domination etc etc. As a Aspiring financial planning practioners, i want my fellow CFP to maintain their dignity as a professionals vs. blame game.

Anyway, if you are talking about education clients, we all have a role to play.

Hi Hemant,

Good article.

Although exceptions are always there with some CAs gaining success in financial planning field too.The problem arises when one perceived to be master of all trades rather than having expertise in some area. All professional programmes brings out your expertise in some specific area.Beyond that you have to assess yourself and see what add value to tour clients.

Hi Hemant

Thanks for the post. I completely agree to your point that personal financial planning is not a core area of expertise for CA. Personal financial planning as a topic is not even there in the CA curriculum….

However, in my view, the bottom-line is the skill sets one possesses and the value one adds to the client’s life… The client is more interested in the deliverable and his/ her learnings from the process, and is not much concerned by the qualification possessed by the person delivering the advice….

Even when one goes about explaining the financial plan process in the first meeting, any knowledgeable client will not take much time to realise that the planner is not just another person to recommend/ sell them this and that..whatever he/she is recommending is flowing from a a well laid out process and basis a thorough product and market research…but it’s a bad idea to pitch financial planning services just by this statement…in short, our actions should speak instead of words!

Sorry missed the disclosure:) – I am a CA as well as a CFP.

We would invite your personal experience.

I liked the disclosure Abhinav…you have edge over others you have both the qualifications

Hemant good post… although i am partially disagree with you here… its not about what qualification you hold its more about market knowledge if talk about a investment or financial advice… What if after getting your CFP certificate you don’t research at all about financial product then your service will be mere arithmetic calculation. It occurs to me many time when i ask a CA about some deduction in chapter VI A he started to look for his ready reckoner. But as far as we talk about CA involvement in Financial Planning profession i am not fully agree with it… if you have the knowledge then serve your clients and if don’t just guide them to us ( Financial Planners ).

I liked your point of view piyush

Dear All,

Let us first consider what is required to be a good financial planner.

1 Good Communication Skills- In order to make clients understand the importance of financial planning in their life.

2 Sound Technical Knowledge- In order to help clients plan and execute their financial plan.

3 Performance- Too add value by enhancing the wealth and improving the financial health of the client.

4 Last but most important Ethics- To safeguard client interest first and then think about your fees at all occasions.

Now let us analyze what both professions have to offer.

Good Communication Skills-The CFP curriculum discusses this in detail in Introduction to financial planning.The CA profession gives practical training on this through a compulsory separate course on General Management and communication skills.

Sound technical knowledge,ethics-I would like to reproduce what Mr. Hemant has said about this aspect first.

CA is an expert in accounting and tax practices.

He is not an expert on assets like Equity and Debt. Also he is not an expert on tracking or researching factors which are must for any investment decisions you take. These factors can be macro like European Crisis or micro like inflation. He may have view on these as a spectator but he is in no way qualified to analyze these facts to form an investment advice.

My view- In CFP things like equity and debt,inflation are taught as though they are complicated concepts. In CA curriculum the topic like inflation and its impact is discussed at the primary level itself.i.e. CPT the first exam to be cleared. Also the debt and equity concept. Topics like ratio analysis gearing concepts in second level of CA profession. Thus these concepts are discussed in both professions but maybe the nomenclature attached with them is different. Thus it is clear that a CA has necessary competency to analyze facts from investment point of view and he is not a mere spectator.

In case of individual investor, a CAs job ceases after he calculates the amount of tax that investor needs to pay. Investments to save this tax fall under the purview of your Investment Advisor or your Financial Planner. He will help you invest a suitable tax saving instrument taking care of your overall portfolio, asset allocation and other needs.

My View- Every good financial planner in this country knows that tax planning assumes lot of importance because you have to shell out nearly 30% of your hard earned earnings with government if you dont plan your taxes properly and thus it is an important part of financial planning. Since CA as profession makes you an expert in it as you have to understand this law in detail to become a CA.Even CFP covers this but not to a greater detail. Now comes the issue of understanding the pros and cons of various financial instruments. The CFP and CA curriculum both cover this. Let me share here that in Final stage of CA there is seperate topic dedicated on mutual funds, valuation of securities,etc. Thus if any CA who is aware of his client profile can honestly guide him about the most suitable investment for him.

CA has no role in Financial Planning. He is not equipped to assist you in your goal planning or risk assessment. Also since he is not an asset expert he cannot help you in assessing your future finances and portfolio. CAs engaged into advising on investment just does it for the sake of not losing their clients or for some monetary gains. Beware as his advice will never be comprehensive.

My View- Goal planning essentially involves understanding your client goals. and factoring the time value of money, risk appetite of client, designing portfolio for client to achieve those goals.This a CFP is definitely familiar with this and also equally familiar is the CA. Let me share that there are dedicated topics in the CA curriculum for portfolio management, beta factor(risk profiling) concept etc. which deal with all this aspects.Thus this point of view of Mr. Hemant does not hold water. Also i express my reservations about the writer stating that CA does investment advice just for the sake of not losing clients or monetary gains.This cannot be practically done by a CA due to the simple reason that he is governed by strict code of ethics and also if you look at the revenue model of CA Practice you will understand that the monetary gains he gets from investment advice to an individual is peanuts as compared to other areas like corporate tax consultancy, audit etc. which ensures his advice is more independent and objective than many CFP who unfortunately even today derive most of their revenues by selling mutual funds ,insurance etc to their client.

Mr . Sadique neelgund’s comments (whom i like to thank for uniting all of us with his honest initiative of starting Network FP) that Completely agree, but CA can double as FP, if he/she learns the game and practices the same has good point considering above facts.

Personally i feel that performance that is what value you add to a clients financial health matters to him at the end of it and if you are able to do that he does not care about what qualification you possess.

One can achieve this only if he is sincere and devoted to help the client and is ethical in his practice.

i think Mr hemant has had not so good experience with some of the people from the CA fraternity and hence has arrived at such premature comparisons between two equally good and respectable professions.

Vinay,

Agreed for the points you have come out for course curroculum in both the fraternity.

However, i do not think we can generalize any comments which has been written by teh author. Yes there are CAs who are very well acquainted with knowledge required for financial planning and there are CAs too who have lost their core competence in trying to earn that extra income. When we discuss what CAs core competenceis then it surely is related to Taxation. Thats what the professional course teaches them.Similarly when we discuss about CFPs then the core competence lies in Financial Planning. To what extent both succeeds in their professions is more dependent on individuals.

Now a CFPs starts saying that i have learnt a module in taxation planning so i am a good expert and starts tax planning services will be foolish.Similarly if a CA starts practice on the baiss of his educational course and not sheer knowledge then it will also be not a wise move.

Professionals like BD surely make the case strong for CAs acquiring FP knolwedge and succeding. But if one want to look at numbers then CAs pursuing this professions without undesrtanding will be higher and thats why this article holds some true facts.Even business standard hade this some days back.

Hence, in my view the writeup cannot be generalize to all CAs as exceptions will always be there.Probably CA with CFP qualification will always hold advantage to other CFPs if taken in the right manner.

@Jitendra Solanki – I would like to point out that CAs are not only trained on Taxation but also in other areas like Accounting, Auditing, Management Accounting, Costing etc., As most of the CAs practice Tax Consulting it doesn’t mean they are trained only on that.

Coming to the question of who is better qualified, it depends on the aptitude of the individual. Just because somebody has a CA or a CFP qualification, doesnt guarantee you a successful career. It depends on the practitioners interest, passion etc., Both the qualifications gives a fair understanding of financial planning and after that it depends on how the individual practitioner continues to build his knowledge base and how successful he/she is in delivering results to the clients.

That is what I told in my earlier comment. CA are more capable to have earning handsome amount by advising taxation, corporate tax consultancy, audit etc. Charges from Financial Planning would be peanuts for them, so it is very possible that they do not care much regarding seriousness of financial planning.

Department has already created environment for earning of CA by making audit compulsory only for One Crore turnover.

There is no compulsion for Financial Planning. Why CA would go for FP service, when there is already a compulsory segment which is really very remunerative.

As there is replacement incentive is much higher for CA, they may not be much serious regarding FP service, putting FP industry in bad shape.

It is really very simple. Legal compulsion for CA service and no legal compulsion for FP really makes a lot difference.

I have already told CA are much superior in acquiring knowledge of FP. It can be peanut for them. So their earning will be peanut.

So, it is rather bad for FP industry.

Has any one some information on such experience with reference to Advance Countries?

It will be really helpful for us to think about the same.

Yep i agree that without knowledge you should not advise anybody about anything and that applies to all CA,CFP and any other class of professional. That is why i have mentioned sound technical knowledge as one of the essentials for being a good financial planner. As i have mentioned earlier past experiences of certain people have lead to such unnecessary comparisons between the two good professions. Both degrees are good enough to provide sound technical knowledge and any CFP without CA and CA without CFP who takes the core principles of his practice i.e. ethics, valuing client needs, studying seriously their curriculum relating to finance(technical knowledge) can become an asset to the profession of financial planning.

Congrats Hemant for the thought provoking article and the subsequent online debate.CFP profession is at its infancy.I have met few CAs who are practising planners.But in my case ,my CA and me are both co existing.I pass on tax filing to her and she in turn passes planning cases to me.Because she realises that she will earn more by focussing on her core efficiency.Ultimately the economic law on”Theory of comparative advantage should settle the matter in the long run”

These are two different professions wherein two different skills required..No doubt both can say they are working in the best interest of the clients.

It’s a matter of experience! How many investors have done so far their personal financial planning through their respective CA? A CA is specialized in handling the accounts, bookkeeping and audit of individual/firms. A CFPCM certificant deals with the financial planning of an individual. A Financial Planner helps his/her clients to deal with personal finances, wealth management etc. Both are required for two different fields. If someone going to a potter where he was supposed to go to a blacksmith, would be possible to solve his problem to a potter? I think this is as simple as that. One interesting fact I want to share with you, once I went to my CA for I. Tax filing purpose, he asked me about my loan O/S, I asked to calculate the same, but he told not possible better to give him the figure, as it was fixed interest rate I took few seconds to calculate and gave him the loan O/S and in the similar way I may not be as good as him in taxation matter.

you may compare the way you want to but the fact remains any person devoted to his client and having sound technical knowledge(that includes CA and CFP) shall easily succeed in the FP profession.A person can be expert in one field or two fields.it depends on his capacity. If you agree that a CA is expert in Audit as well as taxation then you can easily see the point that he can become an expert in finance as well which is part of his core study curriculum.Just because one profession helps a person develop and build his knowledge in multiple fields and the other concentrates in only one area does not make either of the person superior in that particular area. it depends on the capacity and the passion of the person pursuing the same.