September 28, 2021

Decoding 0% Interest Loans

Seema Kakade

Qualified Personal Finance Professional

A few days back I got a call from an unknown number. Without waiting for my response, the tele-caller started off giving me a zero-interest loan for whatever I needed to buy. I was tempted to ask her for a “ZERO EMI” loan but was already eyes deep in work and was in no mood to banter with her. So, I politely declined and disconnected the call. But this got me thinking. With the festive season just around the corner, we see a lot of ads saying 0% loan or very low-Interest Loan.

Offers of zero-cost EMI are running throughout the year and it’s going to look more lucrative as the festive season is around the corner. Is it really what the names suggest? Let’s understand how it actually works. With proper knowledge, you can guide your clients better if they are planning to buy something just because of these lucrative offers of no-cost EMI.

Also, you can send this article to your clients if they want to understand as well how zero-cost EMI works.

But does the 0% interest loan really cost 0%?

How many people would be enticed into this tempting offer? How many of them are actually are aware of what the 0% interest actually entails?

Any consumer durable retail outlet you visit to buy any appliance or gadget, you will find multiple offers like these. There are typically 3 ways that you can opt to buy a product.

- Cash down / Credit card payment / Debit card payment

- Zero cost EMI on your Credit card (If no offer on your CC, they will also sell you a new CC)

- 0% or low-cost EMI (from some financier/bank)

1. Cash down / Credit Card Payment / Debit card Payment: In the Cash down option, you can negotiate and get some cash discount in most cases. This depends on your negotiation skills and how desperate the sales guy is to fulfill his target. Some stores may also charge you some additional fee if you are paying by CC instead of cash payment.

2. Zero cost EMI on your Credit Card: Some CC companies also offer you EMI options on certain products while purchasing from certain retailers. Sometimes, it may be zero-cost EMI, and, in some cases, they may charge you a fee. Please ensure you understand the fine print before opting for such options.

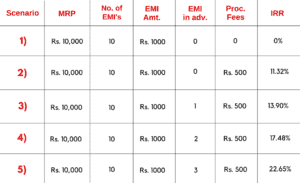

Now let us understand how this works. Please refer to Table 1.

Scenario 1:

You bought a product costing₹ 10000, and you are offered 0% interest on it, so you need to pay 10 EMIs of ₹ 1000 each.

Scenario 2:

Now the sales guy tells you that you just need to pay ₹500 as a processing fee. In most cases, people are fine with it as they don’t consider processing fees as interest. But look at the IRR. It is now 11.32% instead of 0%.

Scenario 3, 4 & 5:

Now let’s see what happens when you pay a few EMIs in advance. Mind you, you are still paying the same amount i.e. 10 EMIs of ₹ 1000 each. But, just look at the IRR. Even with 1 advance EMI, the IRR becomes 13.90%, with 2 advance EMIs, it becomes 17.48 % and with 3 advance EMIs, it becomes a whopping 22.65 %. This is because IRR takes into account the Time Value of Money. (That is a separate topic in itself)

Table 1

3. 0% or low-cost EMI (from some financier/bank): On some products, you will be able to get 0% or very low-cost EMI options. In most cases, the Financiers/Banks have tie-ups either at the Brand Level or at a Product Level, or sometimes even the local retail outlet may have a tie-up. In such scenarios, there are some special discounts that are only available to the financier when the customer avails of the loan facility.

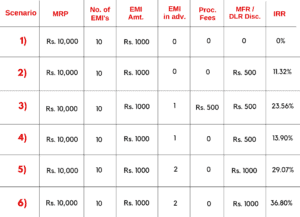

Now let’s see how these discounts (or subventions as they are popularly known internally) impact the IRR. (Refer Table No. 2)

Scenario 1:

Remains the same as in the previous table.

Scenario 2:

There is no processing fee charged but the financier gets ₹ 500 as Mfr / DLR discount. Since you are unaware of this discount, it is still 0 % for you, but the IRR is 11.32 %

Scenario 3:

Now consider, they also charge you a processing fee. You are not aware of the Mfr/DLR discount. Look at the IRR. It has shot up to 23.56 %

Now let’s look at the impact of Advance EMIs on IRR. For the sake of simplicity, let’s consider that you are not charged any Processing Fees. So effectively, it is 0 % interest for you.

Scenario 4:

With 1 advance EMI, no Proc fees, and ₹ 500 as Mfr / DLR discount, the IRR is 13.90 %.

Scenario 5:

All else remaining the same as Scenario 4, if the discounts are higher, say ₹ 1000, the IRR becomes 29.07%.

Scenario 6:

Now if you are paying 2 advances EMIs, the IRR becomes a whopping 36.80%.\

Table 2

Now, these 0 % interest loans are not necessarily bad for you, if you are able to avoid the following pitfalls.

- Make sure that the financier or the credit card company is not going to charge you any interest on such loans in future. Please make sure it is mentioned in the documents/forms that you are signing.

- Always, and I mean always, ensure that you pay the amount due on time. DO NOT give in to the temptation of carrying the due amount to next month. This can entail heavy penalties like the interest of more than 3 % per month (which is about 36% to 42% p.a.) This can also spoil your credit score.

- Ascertain the affordability of the product upfront and ensure that you are not relying on this loan alone to buy it.

There is no harm in opting for these loans if you can strictly adhere to the above guidelines. In fact, such loans can be used to your advantage by ensuring that there is no additional outflow from your pocket due to the loan.

Being Aware is the key to the Right Decision making!

IN TABLE 2 SCANARIO 2, IF FINANCIAR GETS MFR/DLR DISCOUNT HOW DOES IT IMPACT IRR FOR CLIENTS ? FINANCIAR IS GETTING FROM SHOWROOM OWNER AND CLIENT IS NOT CHARGED ANYTHING EXTRA. I COULD NOT UNDERSTAND THIS POINT FROM THE POINT OF VIEW OF CLIENT.

You are right. If the disc is from mfr/dlr, it will not impact the Client IRR. However, if there is Processing fees, then the IRR changes for the customer.

For Table 2, Scenario 2, I have already mentioned that for the client it is still 0 %

Tables showing interest are eye opener, but

But if Amount is more than 25k -50k then what

Charges/costing of IRR…?

Whatever be the Loan Amount, the IRR depends on the time and amount of inflow and outflows. If the discounts are as a %age of the product value and all other variables being constant, then it will not have much impact. But if it is lumpsum, the IRR will definitely differ.

Very nicely explained.

Thank you.

Very well explained Seema.

Hi,

Nice article.

However I am trying to understand how did you arrive at the IRR of 11.32% in scenario 2.

Appreciate if you could show this in excel. We can continue this on email.