June 23, 2020

Giving a purpose to goal-less investments

Nitesh Buddhadev

Nimit Consultancy

Sometimes, life’s best lessons are learned through stories.

A foreman, who was given the charge of a gang of extremely lazy labourers, asked them to dig ten feet deep holes near a large steel mill. The lazy workers were further agitated when they were told to dig the holes here and there. As time went by, they kept digging, and finally they dug up nine holes.

The labourers could not understand why they were being made to dig so many holes near the factory. They also grew desperate, tired, and extremely agitated. They decided to stop right there and not to work anymore. As they were about to retire, the foreman told them something which made them spring back to action, forgetting all their agitation and tiredness.

The foreman told them that he was actually looking for a broken pipe which supplied water to the quarters where these workmen resided. The labourers sprang back to work at once.

To work without a definite goal is not just uninspiring, but also difficult. On the other hand, when a person knows the purpose of what he is doing, he is able to focus better, be more sincere, creative and diligent in what he is doing.

Similarly, to invest without a definite goal is not just uninspiring, but also difficult. When one invests with a GOAL in mind, he is able to focus better, be more sincere and regular in investing.

Going half-way and then thinking of the destination is not a good idea. It’s always better to have clear idea about the destination before starting the Journey.

We all have learnt these concepts of goal-based financial planning. But, how many of our clients have clear goals in mind when they approach us for investment advisory? Not many, right? Yes, most people, when they approach financial advisors come with an investment amount in mind and not a goal. Though we pursue them to define goals and prepare a goal-based financial plan but in some cases it’s not successful may be because investors want to first try our service with small amounts or are reluctant to share all data in initial meetings, or various other reasons including lack of clarity of about the purpose of the said investment. Now, we, as advisors are stuck with this investment amount anchor. In this situation, the challenge faced by advisors is how to maintain discipline and focus in investors and how to manage their behavior.

To understand this, we need to go back to some basics..

The first step is understanding Why do People Invest?

For retirement, a better car, a better home? Or children’s education, child’s marriage? Or luxury vacations? The list is endless.. but it all boils down to “Consume”. Yes, people invest to Consume more or Better in future. This is the ultimate reason / goal for investing. Can we attach some subtle goals to the investments when there is no specific goal in the mind of investor? These subtle goals will help in sustaining the investor’s focus and discipline in absence of a specific goal. Investors generally focus more on the returns and volatility when investments are not linked to goals. Subtle goals help to avoid entangling in this race of fluctuating returns and volatility, direct the investors’ interest and focus from returns to absolute amount and period of investment. The simplest way to do this is to say “Let’s Double your Money!”. This is an exciting and interesting option for an investor belonging to any stage or risk profile. Imagine two advisors pitching to the same client.

Advisor A: You invest Rs 25 lakhs today and you may get 50 lakhs after 6 years!

Advisor B: You may get 12% average return on the invested amount of Rs 25 lakhs over 6 years.

Which advisor would be more appealing to you? Advisor A? Most people will say the same. Though both the above pitches are technically the same, the concept of double gets everyone excited. Also, the focus shifts from return-based to period-based.

The concepts of CAGR, IRR and other financial jargons are not very easily and simply understood by everyone. Instead, give a subtle goal of doubling the money to the investor so he can stick to this goal and wait patiently for the prescribed period of time. This goal will help the investor to be disciplined and continue the investment journey even in difficult times of volatility.

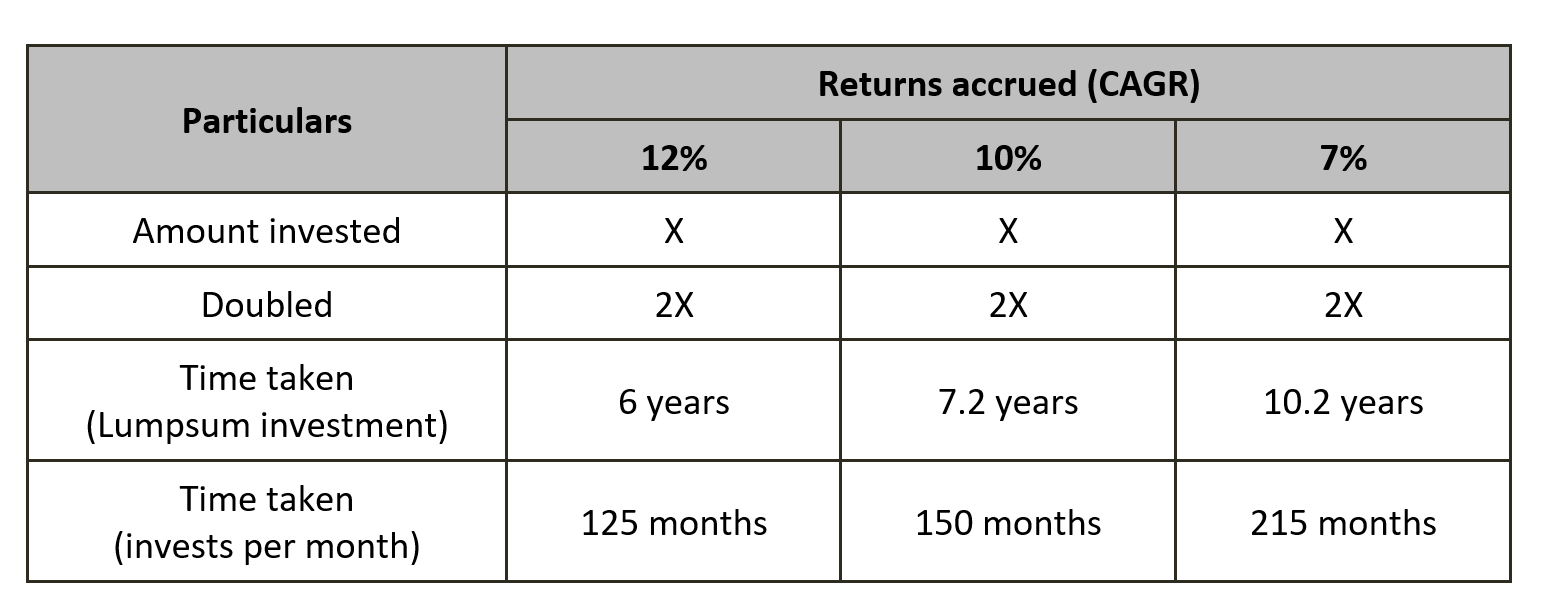

Lumpsum investment and doubling of the principal is quite a common concept. [Popularised by Rule of 72].

Simply, Rs 15 lakhs invested @ 10% will become Rs 30 lakhs in 7.2 years. [72/ percent of expected return]

But double of SIP strategy is something unique to offer to your clients. For eg. Rs 10,000 invested per month will double in 125 months i.e. Total investment of Rs. 10,000 for 125 months = Rs. 12,50,000 will become corpus of ~Rs 25,00,000 at the end of 125th month @ 12% CAGR.

Few more examples are given below:

However, when designing such portfolio, understanding the investor’s risk profile is of utmost importance. Based on the demographics, the investor is at either creation, preservation or distribution stage. Based on the stage the investor is in, his age, and other basic background details, the advisor should assess his risk profile. Based on the risk profile identified and the returns assumed for the portfolio, design multiple options for the investor to choose from. This strategy will create a win-win situation for the investor and advisor both. The investor may not track returns / volatility and patiently wait for the investment period to be over and get double the amount from his investments.

One more example of financial product when no goals are linked to investments is any traditional insurance product which gives you two aspects: (a) the amount of investment (outflow) and (b) the amount you receive after a particular period of time (inflow). This is a very good psychology to keep the investor bound to a particular investment. These products never give them the rate of return earned but only show the inflows and outflows of money over a period of time. Design a similar product in terms of client portfolio for Lumpsum or SIP investment. Two simple examples are given below.

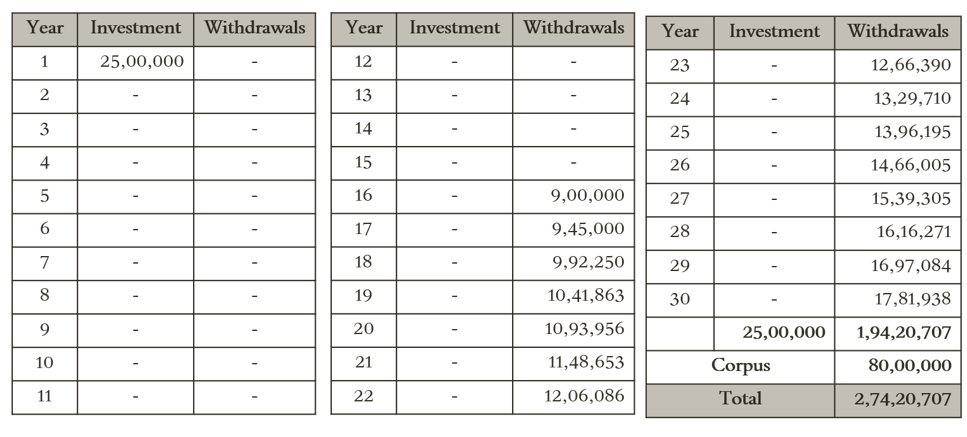

Example A:

- Invest : 25,00,000 at the beginning of the period

- Withdraw : Rs. 75,000 per month (Rs. 9,00,000 p.a.) for the first year, increasing by 5% every year

Key Assumption: Returns expected on overall portfolio @ 10% CAGR.

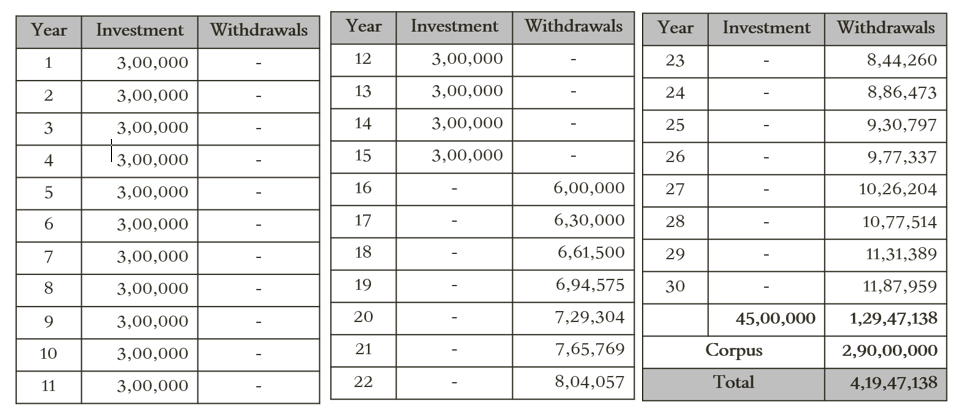

Example B:

- Invest : 25,000 per month

- Withdraw : 50,000 per month (Rs. 6,00,000 p.a.) for the first year, increasing by 5% every year

Key Assumption: Returns expected on overall portfolio @ 11% CAGR.

I am sure, very few people while going through the above example thought of the Returns / CAGR expectation. The focus was on amounts and period of time. Similarly, you can use the above or similar strategies to create a meaningful investment journey and to manage client behavior.

As the saying goes, Setting Goals is the first step in turning the invisible into the visible. So, the next time you face challenges of designing portfolios without goals, use these subtle ideas like ‘Double your money’ and achievable Lumpsum / SIP + SWP plans to help keep investor focus and sustain them through volatile markets.

Hi Nitesh – This is an excellent article. I liked the part where you spoke about using the framework of a traditional insurance product to psychologically link the investor to the investment. Thank you for sharing your thoughts.

Excellent article which will work with young investors

Thank you Mr Ranganath Muthu

Thanks a lot Ninad, Yes the whole idea is to give some purpose to the investments other than return and handling the behavior part well and it will help a great way..

My pleasure Ninad, glad sharing it with fellow colleagues

Very interesting article.

Thank you for sharing the ideas wonderfully and in a simplified manner.

Nice one Nitesh. Goal based investing (against just a focus on returns) is a more positive and panic free approach. The subtle model you have suggested is a good substitute when there is a lack of definitive goals.

Thank you Paddy, yes as mentioned in the article Goal-based is always a superior concept however when there is no clear goal at least we can attach this subtle model which will make the journey more rewarding..

Very good article Nitesh. Simulation with traditional Life Insurance and building similar structure would appeal many investors to keep continuing their regular investment flow.

Meaningful and eye opener article.. Need such inspiring boosters to investor in current collapsed financial situation…Thanks Nitesh for taking such energetic efforts.

Nice one Nitesh.

Had experienced success from both the above suggested ideas in past.

Keep writing more.

Excellent thought Niteshji

Thanks a lot, everyone.

Really appreciate the feedback and acknowledging the efforts.

It’s my pleasure to share my thoughts and learnings through the Network FP platform.