October 5, 2021

How to build a strong SIP Book to grow your business

Deepesh Mehta

Founder & Chief Consultant, Happy Investor Finserv LLP

A professor wanted to explain the concept of simplicity to his students. The professor asked, “how do you eat an elephant?” The students were divided into groups to discuss this problem and find a solution for the question asked by the professor.

A different group of students had different views. Some questioned the professor,” How can such a large elephant be eaten by a human being who is a small animal in front of an elephant?”

One student group said it was impossible. They all then approached the professor for a solution. The professor answered in a simple way. He said – “BREAK INTO SMALLER PIECES AND EAT ONE AT A TIME.” Everyone laughed and understood that simplicity is the way of dealing with a complex situation.

Let us now connect the above example with our business of Mutual Fund distribution.

Every business needs a strong base at the bottom of the pyramid to withstand difficult times. But building a strong AUM base cannot happen overnight. One of the ways to build a business to withstand tough times is by building sticky AUM. A sticky AUM that lasts for long will take your business and your career to the next level.

So the way to build a sticky AUM is through having a great SIP book. Let us understand some ways to build a powerful SIP book.

Our mutual fund industry has an AUM of 36 lakh crores approximately as of 31st Aug 2021. Of this AUM, 34% is in equities and equity-oriented products, and the bulk of the AUM is in debt funds. What this data says is that investors like more debt funds and hence you need to build an AUM with debt funds as well. Industry players such as Mutual funds distributors however advise more equity funds when the data says that debt fund has a bulk of the AUM.

So, in this scenario how do we build a powerful SIP book?

We all are convinced that SIP in equity funds creates wealth, however, the challenge in front of us is that industry data says an average SIP lasts only for 2-3 years. Hence we need to bring simplicity to client’s portfolios. One such way of achieving this is by building a SIP with debt funds. Some of the advantages of building SIP in debt funds are:

- SIP in debt funds will help investors to build emergency funds for those who don’t have one.

- SIP in debt funds will help investors to achieve their short term objectives

- SIP in debt funds will create an opportunity fund (a fund that can be switched to equities during bear markets)

- SIP in debt funds will build a strong asset allocation-based portfolio. As a client’s wealth grows, we all know that having a mix of multiple assets reduces risks in the portfolios.

- SIP in debt fund can bring volumes to your AUM.

This is the simple model we have to follow and do differently from what we are already doing. We are currently advising investors on SIP to create wealth for the long term. If we also use SIP for short-term objectives and as per the asset allocation requirements then as MFDs we would end up having a strong powerful SIP book.

How can a powerful SIP book help us?

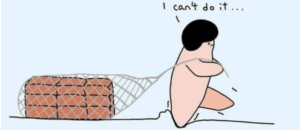

- We all need to build AUMs over a long period of time. One such way is by having a SIP book. Consider SIP as a brick. Brick by brick-built AUM will last longer. Remember the example of the simplicity of how to eat an elephant explained by the professor.

- our monthly SIP book should be 1% of your AUM. For example, if your AUM is 50 Crores, your SIP book should be 50 lakhs. This means a CAGR growth of 12% for your business.

- We all will have good times in our business and bad times in our business. SIP will take care of your business during bad times of the business. During a bear market, when investors shy away from investing, an SIP is a guaranteed way of getting business.

- Most importantly SIP gives a rough projection of your future AUM today. A lot of business-related decisions can be taken with this data.

Hence having a powerful SIP book will keep your business intact.

SIP in debt fund is excellent idea for creating Emergency fund

Thanks for your Guidence

All the best , Khuranaji

Good strategy Deepeshji .. Yes debt SIP is defenitely help us to grow our AUM and multifold and can be used as emergency fund as well as funds to utilise during market falls to switch to equity to create wealth

All the best dear Jagadeesh

Excellent idea about SIP in debt fund for short term goals.

Thank you

Wonderful idea in both the situation like bull & bear. As of now, I do only equity fund.

Simple but powerful way of building sticky AuM through SIP in debt fund

Thank you

Fantastic Deepak, very well communicated.

Excellent Deepak ji

Debt Fund investment should be there and with SIP wonderful idea

Thank you

Simple yet powerful.

I have a question. Generally we know how much should be emergency fund, so we can plan an SIP for that lets say within 12 months my emergency funds corpus should be ready. But my question how to plan for Opportunity Fund. Is there any thumbrule for opportunity fund?

Your opportunity fund SIP could be 15-20% of the equity SIP.Say if SIP is Rs.100000 per month, you can do 85000 in Equity, rest in opportunity fund SIP.

Keep opportunity fund SIP in same fund house where you wish to move to the desired equity fund

Great idea,

Great idea,