April 12, 2022

Is cryptocurrency the right investment for you?

Rahul Bhurat

Chartered Accountant | Certified Financial Planner | Blockchain Enthusiast

This article is a continuation of the first part that was published in the link – https://networkfp.com/is-cryptocurrency-a-right-investment-for-you/

Bitcoin as a currency or a store of value? The argument of Bitcoin vs Gold?

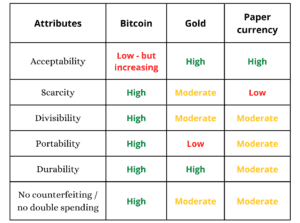

There are various attributes of money defined by economists – acceptability, scarcity, divisibility, portability, durability, and resistance to counterfeiting. Analysis of bitcoin, gold, and paper currency against these attributes is as follows:

As we can see from the above table, while the paper currency is highly acceptable within a society given that it is issued by a sovereign authority, there remain risks relating to unlimited supply, divisibility, counterfeiting, etc. Bitcoin on the other hand satisfies a few of the shortcomings of currency except the fact that it is not issued by a sovereign authority and hence lacks acceptability among the masses. A currency is useful only if it can maintain its value over time in comparison to goods and services in the economy to ensure stability. Until bitcoin’s price volatility compared to the US Dollar is stabilized, it is unlikely that bitcoin will be adopted as a legal tender for large retail transactions on a day-to-day basis.

Historically, precious metals including gold and silver were used as currency due to their acceptability and other inherent physical attributes, however, it was also cumbersome to carry large amounts of such metals. Paper currency was introduced as an improvement to this, however, it requires manufacturing and storage and is easy to counterfeit. The value of paper money was derived from the value of gold backing it.

However, after the removal of gold standards, the US Dollar is not backed by any gold but only by the faith of the people in the US economy. With the US Federal Reserve printing trillions of dollars each year, it is pertinent to ask, for how long can the US Dollar keep up its value given that the dollars that the masses hold are becoming less scarce each day?

Bitcoin as a store of value:

Store of value describes any asset that can maintain its value over time without depreciating, such as precious metals or some currencies. To understand this, we must take a long-term view of Bitcoin’s price action.

Being a relatively newer asset, bitcoin has seen a significant increase in its price since its inception, which is unlikely to occur in the future. Throughout most of bitcoin’s history, speculation was the primary driver of Bitcoin’s value. However, with the increase in adoption of this new asset among the masses and higher acceptability as an investment class among large banking groups, it is expected that volatility will reduce.

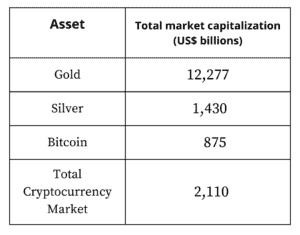

The table above shows the total market capitalization of bitcoin and the total cryptocurrency market versus gold and silver. While gold and silver are mature markets, bitcoin and other cryptocurrencies are beginning to attract funding from large institutional investors. Given that there is a significant gap between the market caps of precious metals and bitcoin and while bitcoin may or may not surpass the market cap of gold, it certainly seems to have the potential to multiply from its current market price thereby providing handsome returns to those institutional investors (assuming gold’s price remains constant).

It is also worthwhile to note the fact that while there are billions of investors including central bankers holding gold on their balance sheet, there are less than 100 million separate account holders holding bitcoin (according to blockchain.com). This implies that there is significant scope for penetration and growth once positive regulations are enacted globally and a stable market place develops.

Should I invest in cryptocurrencies?

Why should I not?

Unlike real estate, gold, or to an extent stock market, a cryptocurrency’s value is not underpinned by any intrinsic value. It is a code backed by logic or a smart contract and hence the value is determined by only one thing: confidence. Confidence in the project and confidence that there will still be demand even when the price keeps rising. Bitcoin’s value is based mostly on speculation which is very different from company stocks where the share price will move depending on how the business is performing.

One should not invest in cryptocurrencies if the aim is to get rich quickly. We might have heard stories that someone invested a few thousand dollars in a project and has become a millionaire in a couple of years. However, equally true and unknown are those stories where people have lost thousands of dollars expecting that the price would multiply 100x in a few weeks or months.

Why should I consider it?

While there is no clear rationale to increase or decrease the prices of cryptocurrencies, it is important to note that most blockchain technology companies are in their early, if not very early stages. Hence, investing in companies utilizing blockchain technologies has the same risks as investing in a tech start-up. Like in any start-up, the risk-reward ratio is high. The key is identifying such projects at an early age by performing due diligence on the nature of the project, the problem it intends to solve, the team, tokenomics, token vesting schedules, partnerships, project timelines, and public announcements.

Owning some cryptocurrency can increase your portfolio’s diversification since cryptocurrencies such as Bitcoin have historically shown almost no price correlation with the stock market. Bitcoin has had its own 4-year cycle (popularly called the halving cycle where the mining rewards are reduced by half approximately every 4 years).

From a financial planning perspective, any investment in such assets cannot and should not be linked to a life goal in your financial plan. Like traditional assets, it’s best to treat cryptocurrency as a long-term investment to give you the best chance of making money and never invest more than you can afford to lose.

Besides politics and sports, cryptocurrency is one of the areas where people are strongly opinionated. Irrespective of whether or not one is an expert, everyone has an opinion on whether one should invest or should stay away from investing in cryptocurrencies. Such opinions largely relate to one’s bias and risk appetite – aggressive or passive. However, a successful investor or a portfolio manager would be the one to keep his/her bias aside and judge an investment purely on data.

For example – one might dislike Apple phones or even Elon Musk, however, if the stocks of Apple or Tesla show strong fundamentals and are expected to rise significantly according to one’s technical analysis, bias should be kept aside and suitable allocation should be made in the portfolio to increase portfolio value. Similarly one might not expect to be invested in the cryptocurrency space in long term, however, if it helps to grow one’s portfolio the fastest within the overall portfolio risk (with proper research), and within the given timeframe, it would be too passive and uncompetitive to ignore such an investment allocation.

Can I invest by myself or do I need a financial advisor?

Cryptocurrencies are fast-paced and it is important to keep oneself updated at all times. The cryptocurrency markets operate 24×7 for 365 days. Any news in the world can have an impact on the market. However, as long as an investor keeps his or her eyes wide open, understands the risks, and has a grasp of the dynamics of liquidity in the market, he/or she can certainly invest by themselves.

Smart investors understand that the question is not only about which cryptocurrency is good, but also about when is the right time to enter/exit the market. These investors also develop the buy and sell strategies even before they enter the trade. Such investors have a good deal of emotional detachment, which can be difficult for many average investors. This market thrives on the human emotions of fear and greed. Without sounding too spiritual – the investor’s who go beyond the fear and greed phases of the market, are the ones who truly multiply their crypto portfolio.

The questions to ask oneself before investing in cryptocurrencies are:

- Do I understand what I am investing in (have I done sufficient due diligence) and how bitcoin and the crypto market work?

- Am I happy with the level of risk compared to the overall portfolio risk?

- Am I happy to invest only a small amount of my disposable income and be prepared to lose

- Do I know the fact that only a small number of cryptocurrency projects will ultimately flourish and the rest will shut down?

- Am I reasonably careful to not fall into the traps of a third party luring or promising a certain return in certain days (scams)?

- Do I make sure not to click on unknown links or share personal information elsewhere to ensure I don’t fall into the possibility of cyberattacks, phishing, or theft?

While there are some very good advisors and portfolio managers who are active and provide specialized services in the crypto space, not only to investors but also to other financial planners, most of the so-called new age advisors do not have the required qualifications and do not follow code of ethics thereby remain prone to various scams and liquidity rug-pulls (large token holders create artificial demand and spike in prices, then sell the tokens to new investors who thereafter are unable to sell due to absence of liquidity in those tokens).

New investors who are greedy are attracted to advisors who make tall promises similar to how a moth is attracted to a shiny flame. A genuine cryptocurrency financial advisor who understands the nuances of cryptocurrencies can help clients make informed decisions about whether or not this nascent asset class fits into their portfolio, and how it might ultimately help or hinder them from achieving their financial goals.

Disclaimer: The writer has investments in cryptocurrencies and also manages a portfolio of cryptocurrencies on behalf of his clients. Please do your own research before investing in cryptocurrencies. The writer is a Chartered Accountant, and Certified Financial Planner, and also holds a certificate in the application of blockchain technology from MIT.

Once sovereign currency starts their digital version (like digital rupee), most of the issues mentioned about paper currency will go away.

The biggest issue in the fiat currency issued by a sovereign entity is its lack of scarcity. The Governments can print/issue at their own will without any checks. This was the main reason why Bitcoin was launched in 2009. With digital currency, this issue in fact exacerbates, because now, central banks/FED don’t even need to print the currency. They can simply add digits digitally and they would have created capital out of nothing. USD is not backed by anything, so it’s easy to create more of those digital dollars easily.

The biggest issue in the fiat currency issued by a sovereign entity is its lack of scarcity. The Governments can print/issue at their own will without any checks. This was the main reason why Bitcoin was launched in 2009. With digital currency, this issue in fact exacerbates, because now, central banks/FED don’t even need to print the currency. They can simply add digits digitally and they would have created capital out of nothing. USD is not backed by anything, so it’s easy to create more of those digital dollars easily.

@Gautam Shah

The biggest issue in the fiat currency issued by a sovereign entity is its lack of scarcity. The Governments can print/issue at their own will without any checks. This was the main reason why Bitcoin was launched in 2009. With digital currency, this issue in fact exacerbates, because now, central banks/FED don’t even need to print the currency. They can simply add digits digitally and they would have created capital out of nothing. USD is not backed by anything, so it’s easy to create more of those digital dollars easily.

Bitcoin will be accepted well when

1) Its accepted by all major govts as medium of exchange, sell & buy of goods & services

2) well regulation, check & balances should be in place.

Its good for professional people to trade on bitcoin. Nice insight & knowledge sharing about bitcoin with data & facts. Thank you so much Rahul ji