August 11, 2020

Embedded Value of a Life Insurance Company

Rajaraman Radhakrishnan

Head - Sales Support Strategy and Training at Shriram Life Insurance

In India currently we have 24 life insurers including the PSU giant LIC of India. Typically, life insurance business is a capital intensive financial services business with a long gestation period of profitability.

The financial results of a life insurance company are complex to analyse. They are prepared in accordance with the regulatory and actuarial guidelines issued by the respective authorities. A simple profit and loss account does not reveal the true picture of a life insurance company. The Profit & Loss account, Solvency Margin and lastly the embedded value are used to understand the performance of a life insurance company.

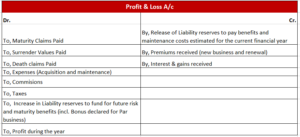

Unlike a manufacturing organisation, the P & L account does not give a true financial picture of a life insurance company. A typical P & L account will have the following heads.

In the first year of the new business, the cost of acquisition and the value of additional reserves, called the new business strain, lead to loss for a life insurance company. Typically, a regular premium product will have an effect of high initial loss in the first year and subsequently an expected stream of profits over the balance term of the product. The logic is simple- The inflows from such products remain steady over a time period but the burden of initial business expenses and the burden due to smaller business base eases out over the same period of time.

We need to remember that there are quite a few assumptions in the pricing of the insurance product like Mortality rate, Persistency rate, Interest rate to name a few. The assumptions are mainly derived from past company experience, and regulatory reserving practice requires that valuation margins be added to allow for possible deviations in future experience in order to protect policyholders’ interests. These margins serve as a buffer range to account for situations where these assumed statistics don’t hold true. Subject to the life insurance company’sexperience in achieving the assumptions, the valuation margins will be released as profit (i.e. added to the profits gradually) and accrue to the company over a longer period.

The valuation margins achieved from existing business in a financial year can be used to help cover the new business strain (refer to the paragraph below on the P&L account format to refresh what a new business strain is). Therefore, if a life insurer writes marginally lower new business, the reported P&L account will increase due to reduction in new business strain, compared to valuation margins achieved from the existing business for the year (it is in a way averaging of the business strain) However, the value of future valuation margins added by the tranche of new business for the year in question will also be less, causing a slowdown in the growth of the company’s market value. The P & L account on its own is therefore not an appropriate measure of Life Insurance Company performance in terms of value creation.

The combination of capital (derived from P&L and shareholders’ investment return) and value of future margins for existing business is used to estimate the Embedded Value. The value of the future margins are calculated by discounting the projected future profit, using a risk discount rate.

Embedded Value is calculated as follows:

EV = PVFP + ANAV

Where

EV = Embedded Value

PVFP = present value of future profits of In Force policies

ANAV = adjusted net asset value

Net asset value is the difference between the total assets and liabilities of an insurance company.For companies, the net asset value is usually calculated at book value, which is adjusted to market values for EV purposes. Embedded value does not take into account the potential and capability of the life insurer in mobilising future new business as the measurement is confined to current in force policies only.

Assumptions again play a very critical role in the embedded value calculation. The embedded value of a life insurance company is very sensitive to the assumptions underlying the calculation. Therefore, it is important that the methodology used to set the assumptions must lead to realistic and objective assumptions and at the same time need to ensure consistency over a period of time.

The assumptions used in the embedded value calculation can be mainly splitinto two categories: the economic and the non-economic assumptions.

Assumptions relating to the economy and capital markets are classified under the Economic assumptions category like future reinvestment rate on fixed income investments, future return on equity, currency exchange rates, inflation rate and future expenses rate on investments. Non economic assumptions are normally covered during the valuation exercise by the actuaries and these assumptions inter alia are assumption on Mortality, Persistency, expenses overrun etc.

Embedded value also changes based on the assumptions, perception of the economy depending on the actuary and his valuation methodology. Embedded value is calculated as on a particular date and it keeps changing between any two dates.

The following factors contribute to the movement in EV between any two dates:

1. Changes in reserves post the last EV date

2. Value addition from New Business,

3. Changes due to Economic assumptions

4. Changes in operational assumptions,

5. Dividend paid,

6. Infusion of capital etc…

To provide more insight into the drivers behind the Embedded Value, a life insurer reports the increase in Embedded Value over a year in the form of an experience analysis, and analysis of change in assumptions, Mortality, persistency, etc.

Embedded value is not equal to the market value of a life insurance company. Other factors like Franchise value, Confidence in EV and market sentiments will have an effect on the market value. Franchise value represents the ability of the insurer to grow profitable new business, which includes distribution capability, distribution channel mix, product composition etc.Confidence in EV is the ability to generate capital returns and pay dividends from the value which is implied in the EV. Market sentiments refers to the overall economic outlook, investor sentiments, market standing and goodwill of the life insurer. All these factors lead to the market value being equal to a multiple of EV.

Thus EV represents a fair measurement of a life insurance company and this has to be ascertained with the other factors as well during evaluation of the market value pricing of a life insurer.

Secondly, similar to capital adequacy norms for a lending institution, Solvency margin represents an additional layer of financial soundness, which the regulator needs to protect the policyholders’ interest. The Required Solvency Margin (RSM) is calculated as the higher of a prescribed % of liabilities and a % of the sum at risk for the policies. The Available Solvency margin (ASM) is the capital assets (excess of value of assets over that of liabilities) admissible to back the RSM. The solvency ratio is the ratio of the ASM to the RSM. The higher the ratio, the more financially sound a company would be considered. The required minimum solvency ratio is currently 150 per cent, to be maintained at all times. The regulatory investment norms adds another layer of prudence and require that the assets backing the liabilities and the RSM are invested 50% in central and state government bonds. All these security measures together ensure that the life insurance company remains solvent as a going concern in most foreseeable future circumstances, to the advantage of all its stakeholders (policyholders, shareholders and employees).While the Solvency method is determined by the Regulator, the P&L method is determined by the guidelines of government and the statutory Accounting body. The Embedded Value method is determined by the Institute of Actuaries. These methods together aim at ensuring proper governance and performance measurement for the life insurance company.

Great article. Nicely presented. The fact that if a life insurer writes marginally lower new business, the reported P&L account will increase due to reduction in new business strain took me by surprise.

insurance is not a mathematics , to understand these any one have to understand what is crisis management

Embedded Value and solvency margin beautifully explained with clarity, in a simple language. This article will be useful to people from both insurance and non-insurance back grounds.

Nice Article Sir.