March 16, 2021

A refresher on Dr. Mukesh Jindal’s session on Asset Allocation

Arijit Sen

SEBI Registered Investment Adviser

As investment professionals, one of our all-important spheres of work is crafting investment asset allocation for our clients. Observing the present dynamic environment, Network FP invited Dr. Mukesh Jindal to take a session on asset allocation. The session during last month’s MasterClass on 24th February, 2021 was set up with a view to add value to our approach in managing our clients’ portfolios, especially during questionable times like these. Based on his own doctoral research done in 2015, Dr. Mukesh Jindal wonderfully shared how asset allocation strategies can actually add value to clients’ portfolios.

We attempt to capture the essence of the session by drawing up an easy to follow guide. Through the following questions, it may put you on the fast-track to being able to excel the art and science of investment asset allocation.

It’s an undeniable fact that our clients seek maximum possible return on their investments while they are ready to experience least market volatility. As investment professionals, at times, we face challenges as clients cannot accept the matter that risk and return go hand in hand. People often confuse asset allocation with diversification strategies. When it comes to investing, asset allocation is as important as diversification is. By default, clients are having their assets in various buckets. Parts of their investments are already in Fixed Deposits, Mutual Funds, Real Estate, Gold, etc. Now the critical question – How can we improve/ add value to clients’ existing investment portfolio and fresh investments?

Q.1 What helps to improve portfolio returns?

- The solution is focused towards asset allocation. We need to understand the art and science behind the same. It’s not just about basic asset allocation. It is a multi-layered approach at the core of which is Strategic Asset Allocation

Decoded: It is decided through financial planning and risk profiling. This involves factoring in how much risk or uncertainty the client can stand and also what asset classes suit their investment time horizons and goals. Also, another chief factor to focus on is the liquidity of available investment choices.

- The next layer to this activity is Rebalancing.

Decoded: It dictates you to stick to the core asset allocation. Suppose there’s a client with moderate risk taking capacity. Suppose, their strategic asset allocation demands that, you maintain Debt: Equity ratio as 50:50. If there’s a bull run, Debt: Equity ratio shifts to say, 60:40. So, rebalancing strategy suggests you to switch 10% of equity portfolio to debt.

- The third stage or layer is Reallocation. It’s also known as Tactical Asset Allocation.

Decoded: This is a stride forward in managing our clients’ portfolios. It is about dynamically shifting from the core asset allocation based on market outlook. If you feel that markets are expensive, then you may want to reduce the equity exposure of a client having moderate risk taking capacity. Similarly, if you feel that markets are cheap, you may want to consider this as an opportunity to create wealth in the long run. Thus, you may decide to increase equity exposure of a client beyond the Strategic Asset Allocation. This involves taking calculated steps outside of the circle of strategic asset allocation.

- The final step is the stock/sector selection.

Decoded: Most of us are outsourcing this task by banking on Mutual Fund Managers/ PMS/ AIF Managers. Few investment professionals among us are also doing this exercise on their own for their clients.

So, basically the investment portfolio return is driven by the above four strategies. All of these strategies are top layers.

Q.2 How much do these strategies impact a portfolio’s risk and returns?

There was a research paper published in the US in 2000 by Ibbotson and Paul D. Kaplan.

According to the research paper the portfolio return depends on the following factors:

- Strategic Asset Allocation

- Market Timing

- Stock Selection

They found out that 91.5% of total portfolio return is depending on asset allocation. Basically, other factors are not playing significant role in contributing to the total portfolio return.

Of course, the study is from the US which is a much matured market compared to Indian market scenario. But, we do have this feeling that there’s importance of active management whereby Fund Managers generate alpha. Not convinced about the results, Dr. Mukesh Jindal did his doctorate on asset allocation in 2015 based on Indian markets.

He recognized that the research by Ibbotson and Paul D. Kaplan was focused on portfolio returns. The risks involved in different kinds of strategies were not covered. Also, they used only monthly returns which is a bit short term data for analysis purpose.

Dr. Mukesh Jindal is kind enough to share the data based on which the study was carried out.

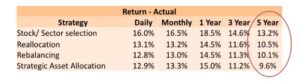

A significant aspect to consider is that Rebalancing and Reallocation does not add value in the short term. Frequent rebalancing/ reallocation can prove to be counterproductive.

This doesn’t give us the complete picture. We need to give relevance to the risk factors.

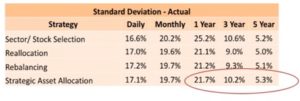

For Strategic Asset Allocation, Standard Deviation, being a measurement of risk, is 21.7% in 1 year. It reduces to 5.3% over 5 years. Thus, if tenure of investment increases, risks reduce significantly. Key learning here is that the biggest risk reduction strategy in a portfolio is long term investment horizon.

Risk component of Rebalancing and Reallocation is also quite there (data given below).

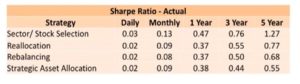

Along with Standard Deviation, Sharpe Ratio is also taken into account. It is the risk adjusted return. It tells us how much return per unit of risk is being generated.

- By following Strategic Asset Allocation, Sharpe Ratio is 0.55 over 5 years.

- It improves to 0.68 because of

- Further, it goes to 0.77 because of

- Scientific Sector/Stock selection improves the ratio to 1.27.

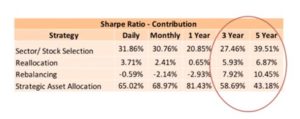

Below statistics states that all the strategies have significant role to play from portfolio return generation point of view.

What’s important is to note that this provides opportunities to all investment professionals like us. We can add far more value to clients which extends beyond financial planning and basic asset allocation.

Since the study was done in 2015 by Dr. Mukesh Jindal, things have changed quite a bit. One concerning factor is that Fund Managers’ contributions in delivering alpha and improving portfolio return has reduced significantly. It may be specific to a range of market cap. From this state, the Rebalancing and Reallocation will become increasingly relevant. We need to build our skill set accordingly.

Q.3 How does a well-thought out asset allocation boost portfolio returns?

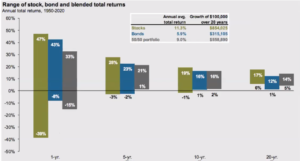

The below chart showing US data is shared to focus on the fact that the tendency to deliver negative returns by both stocks and bonds reduces with increasing time horizon.

- Over 20 years timeframe, bonds gave minimum 1% and maximum of 12% return.

- While stocks delivered minimum return of 6% and maximum of 17% annual return.

- On the other hand, a portfolio having stocks: bonds ratio of 50:50, gave minimum return of 5% and maximum of 14% annual return.

People perceive that bonds/ debt are safest investments, they carry less risk. But the data shows the reality. Even over 5 years, it may give -2% returns. On the other hand, a hybrid portfolio may perform better.

Q.4 What’s happening in India?

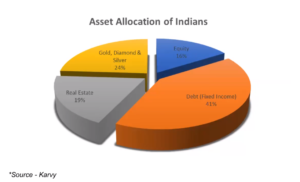

Below pie-chart has been taken from Karvy which shows the asset allocation of Indians.

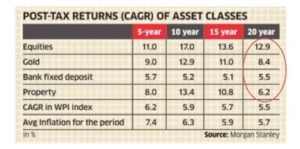

Only 16% is allocated in Equity which has given considerable return over 10/15/20 years. Rest 84% is lying in other asset classes. We do have a lot of scope in here to financially educate people and make them invest in various asset classes based on their requirements and risk profile.

Again, when it comes to investing, we are mostly invested in domestic equity (Indian markets). But global economies have actually done better in terms of providing investment returns. Below chart from Kotak MF NASDAQ Fund presentation shows the actual scenario. 7 out of 11 times NASDAQ- 100 TRI has outperformed Nifty 50 TRI since calendar year 2010.

So, it’s evident that there’s further scope while designing asset allocation for our clients by taking international exposure. Obviously, the decision shall be based on your own research, client’s requirements and risk profile.

Q.5 How are global HNIs investing?

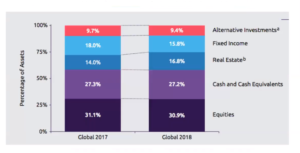

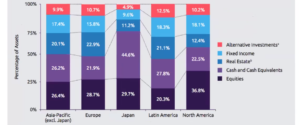

Below data has been taken from Capgemini from a report shared in 2019. This shows how HNIs are holding their investments.

Indian HNIs are having less exposure in two asset classes, viz. Equities and Alternative Investments. Their exposure in Debt is higher. This is primarily because interest rates are high in India compared to other countries round the world. This provides a comfort zone to them. The approach is appearing to be changing though.

What happens in developed markets will eventually happen in India. Thus, the above chart indicates the way forward. To add value to your HNI clients, you need to consider taking exposure in Alternative Investments and also increase exposure in Equities banking on your own research, client’s requirements and risk profile.

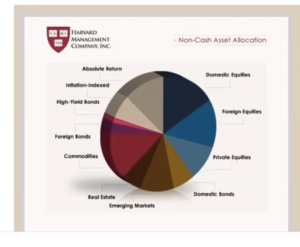

To get an idea how efficiently asset allocation can be done, let’s consider how Harvard Management Co, Inc. is holding the investment assets they manage.

If you compare the above chart with the type of asset allocation you are maintaining for your clients, it shall give you a fair idea how and where you can improve. Before implementing any strategy it’s absolutely important that you understand what you are doing. You can surely add value to your clients by understanding the correlation between asset classes.

Q.6 Asset Allocation @50K Sensex: What to do?

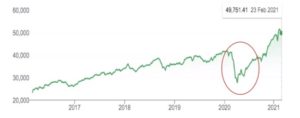

Many are confused about what to do with existing investors’ money as markets are at all time high. We can uncomplicate things by following the asset allocation strategies.

Suppose, a moderate risk taker was maintaining 50:50 portfolio of Debt: Equity. When markets fell in March, 2020, say by about 35%, the existing asset allocation certainly got disrupted. Say, Debt: Equity became 60:40. A simple Rebalancing strategy would have been to shift 10% of Debt to Equity and reclaim the exposure of 50:50. Thus, the investor was buying when markets were down. In February, 2021, we are witnessing that markets have significantly gone up. Even now, the asset allocation has been disturbed. Say, Debt: Equity became 30:70. This is a signal that investor shall sell Equity and move to Debt so as to maintain the ratio of 50:50. Here again, the investor is selling when the markets are up.

So, present scenario demands you to visit your clients’ requirements, their respective asset allocations and their risk profiles before you take any steps.

Conclusion

You need to generate new ways of adding value to your clients. It’s better not to bet too much on stories around the markets. Discipline is the key to wealth creation.

Simply superb!

superb!

Excellent and well written article with insightful data!

The only search is for a well known Re balancing tool that will work on existing portfolios to take advantage of market movements for clients in large nnumbers.

Complete guidance to manage money

Excellent article and even the session was with limited time!!

Actually in the fast moving world with lots of volatility it becomes very difficult for a large retail base.

I feel that making BAF category a base for investments the asset allocation can be practiced safely with large retail base.

Comments wel-come!!