June 16, 2020

Ensuring a Financially Fit Next Generation

Kunjal Shah

Director, Getting you rich

This lockdown due to Covid-19 has given us many life-changing lessons. We understood the importance of immunity for our physical fitness and the importance of emergency corpus for our financial fitness.

Every parent wishes to make their son or daughter very successful in their life. They try to give them the best academic and overall education. Still, they underestimate the importance of financial knowledge for them to become successful. Being financial advisors, we can help parents/clients in this initiative to make the next generation financially fit. We can create our financial awareness programs for the next generation and deliver it via online/offline sessions. By doing so, we can have benefits like:

-Content Design

You can create your program by using your financial knowledge and creativity. Here, I am sharing what we do, just for the sake of guidance.

When it comes to the content, we can start with basic money concepts and move on to complex ideas, financial planning to the real experience of investing.

We can broadly divide our content and session delivery according to age groups as follows:

Kids and Money

(8 to 12 Years of Age)

- Save for emergencies

- Save for goals

- Budget

- Banking

- Need v/s want

Teens and Money

(13 to 17 Years of Age)

- Instant gratification

- Delayed gratification

- Inflation

- Pay yourself first

- Magic of compounding

Youth and Money

(18 to 21 Years of Age)

- Don`t put all your eggs in one basket

- Financial freedom

- Different asset classes

- Financial planning/benefits/process

- Open MF account and start sip

– Engaging Tools

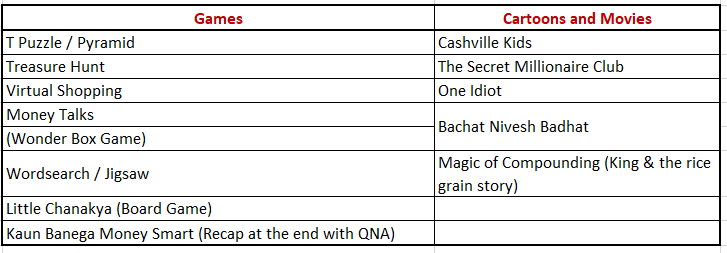

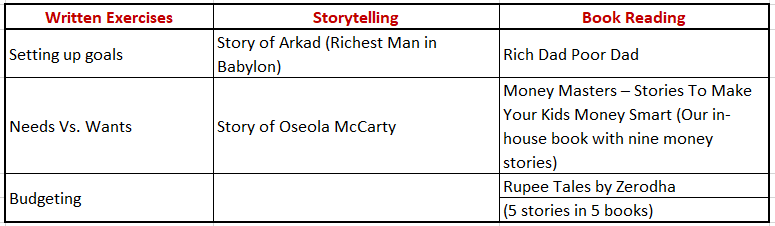

When it comes to delivery of the session, we need to design it to make it fun-filled and rewarding. Every activity should be interactive, informative, and engaging. I am sharing some tools that can be used.

Further, every AMC has booklets / Games / Calculators and other educational resources available online or offline. The same can surely be used to add effectiveness in our sessions.

– Suggestions for a Superhit session

Having conducted such sessions as group activities as well as on a one-on-one basis, for the last five years, here are some suggestions based on our experience.

- Start offering free sessions: When you meet your client, share about your newly launched service and invite their children to your office and deliver the session.

- Start with 90 to 120 minutes’ sessions with 3 to 4 topics. If the session is at your office, offer refreshments.

- Prepare your team: As you will be busy with core investment strategy decisions and meeting the clients, you can create the program, and your efficient team members can deliver the session.

- Rule of 15-20 minutes: Start with 2-hour sessions and try to finish any activity in 15 to 20 minutes at the maximum and then change the topic for better attention.

- Activity-based sessions: Design power-packed sessions using Games, Movies & Group Activities.

- Gifting: Play some games and give chocolate to the winner as an icebreaker. Create healthy competition and give gifts like small pouches, storybooks, or chocolates. Everyone loves chocolates and gifts.

- Participant Kit: Prepare a participant kit with games, written exercises, money storybooks, pad, pen, and participant certificate. Use bags with your brand name and make it your marketing tool.

- Be Creative: Write Money stories and publish E-books or physical books, create games, and use in your sessions.

- Online class: Due to the lockdown, everyone, including kids, are used to online sessions, so we can design our online sessions and deliver them.

- Group Photo & Testimonials: Take a group photo, ask for video testimonials and post it on all your social media platform accounts. Ask them to give feedback so you can be better. And call them for such sessions at least once every year.

After attending such sessions, kids and teenagers save money for emergencies and goals from their pocket money. Youngsters open MF accounts and start SIPs. That’s the power of financial awareness.

Three cheers for a Financially Fit Next Generation!

Very good program and good way designed in age wise separately

Thank You, Deepali for your nice comment

really commendable

iam sure these sessions will be useful

Thank you so much, Mr. Narayan

These sessions create awareness towards money and the next generation is very smart.

Excellent ideas for kids money program. Thanks Kunjal !

Thank you so much Sadique

Good experience sharing. Hope the advisors will make the best use of all the tips & techniques shared here.

Thank you, Rohit

great Initiatives Kunjal ji .. would appreciate if you can share some demos for it as it will give more clear idea of how to conduct such sessions now

Hello Sachin Ji,

You can write an email to kunjal@gettingyourich.com, I will definitely help you with some demo guidance.

Good program

Thanks for sharing Kunjal, brilliant insights..!

Thank you, Roshni

All these points are well thought and demonstrate the insights of someone who has deep experience in engaging with the next generation.

Thank you, Ruchik

Article describes the current scenario, it depicts the importance of financial planning from the young age. The mind mapping in form of palm was excellent. The age wise distribution was also very good. Write more articles.

Thanks, Sejal for encouraging me to write more.

Good technique used Kunjal. Gives us the insight of the financial planning approach applicable for various age groups and how we can stand out by implementing fun and interactive session.

Nice and informative article.