May 5, 2020

How to help individuals choose between the Old and New Tax Regime for FY 20-21

Arvind Rao

Founder, Arvind Rao & Associates

I remember my friend Abhishek (the last one from my college group who got married just last year) and his happiness when he announced (in May 2019) that he was going to get married in December 2019. Initially, for him, it was like he just couldn’t wait for these months to get over and be married. And then on the penultimate day of his marriage, suddenly, I found him developing cold feet. Abhishek was not sure whether he was (still) prepared for marriage or not – can you image this?

We (his other batchmates) were celebrating our first decade anniversary of our respective marriages and here goes Abhishek who thinks he’s still early.. Finally, when he turned to me to share my experience, I just had one sentence for him – Just do it and experience the journey for yourself. Although I could have given him loads of gyaan (some self-acquired and some borrowed), I refrained myself as it was important for him to first start and then understand his own adventure and thrill-filled journey, otherwise commonly known as the ‘married life’

- Should have CFP/NISM Level 1 & 2 Investment Advisor certification and NISM V-A MF certification

- Diploma or Bachelor’s or Masters degree in any discipline.

- Relevant work experience of at least 2 years.

- Should have CFP/NISM Level 1 & 2 Investment Advisor certification and NISM V-A MF certification

- Diploma or Bachelor’s or Masters degree in any discipline.

- Relevant work experience of at least 2 years.

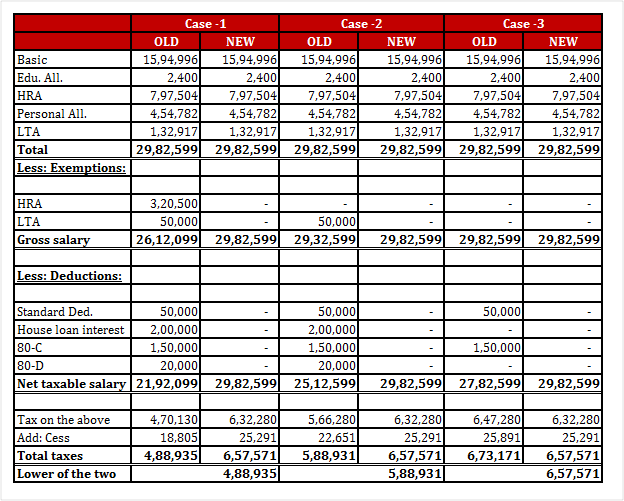

To understand this situation practically, lets look at how the calculation and comparison works out for three different cases on the same salary chart.

Case 1 looks at the tax computation and comparison for the individual, who is claiming exemption benefits under HRA, LTA and deductions for home loan, section 80C and 80D and standard deduction.

An interesting point to note here is that this declaration to the employer (by the individual) is not the ultimate decision point, the circular (13th April) states that though the employee cannot change his declaration once done, he/she (as a tax filer) can still decide and take the final decision before filing of returns. In other words the individual may have opted for the new regime at the start of this financial year, but he can still opt for the old regime before he files his return of income next year.

While Leadership quality is in every one of us, it’s good time now to identify, nurture and showcase the same, as applicable. It’s all about asking yourself time and again – How can I make the situation better, for others ? The best in oneself should be brought out, only, in a crunch situation. Good luck.

Test Comment

This is a test

Testing