February 22, 2022

Importance Of Life Planning In Financial Planning

George Kinder

Founder & President, Kinder Institute Of Life Planning

You can’t do financial planning without doing life planning.

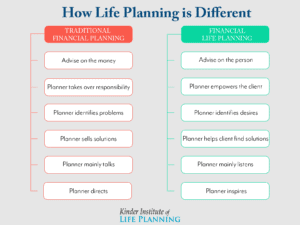

Life planning puts the client first. It is the relationship-building methodology that enables a financial planner to truly be a fiduciary to their clients. The process allows time for discovery and room to build the trust that most consumers lack for financial advisers.

As financial life planners, we listen to who the client really is and who they want to be, to their feelings and to our own, and the nuances of a developing relationship.

Without listening, you’re imposing your agenda on the conversation and judgment on your client’s life. The client ends up feeling like you’re a salesperson and that’s the last thing you want. We listen without interruption. In fact, we hardly say a thing in the initial meeting. We just draw our clients forth by responding to what they share with empathy, encouragement, or enthusiasm but not asking further questions.

Kinder Institute of Life Planning trains financial planners in a five-step structured interview process called EVOKE® (Exploration, Vision, Obstacles, Knowledge, Execution) that is used to uncover clients’ most exciting, meaningful, and fulfilling aspirations so that the planner can efficiently and effectively support their clients’ lives with their financial expertise.

Exploration

In the first client meeting, we’re giving the client the opportunity to reveal themselves and to share who they are and what they want in life. We are there for our clients without judgment.

The client might begin by talking about money but then quickly digress to more meaningful personal topics such as sharing about their kids or their spiritual practice or how they want to help their community. With excellent listening and by building this layer of trust, clients begin to feel more comfortable sharing the aspirations that profoundly move them. They’re sharing what they love, not talking money and stocks and taxes and insurance and all the rest.

That means they are trusting you to take care of those financial matters for them, linking them appropriately to their personal dreams.

Many of my clients have shared that this was “the best conversation of their life” and the reality is that they did 90% of the talking. Financial life planners often provide their clients after the first meeting with inspirational exercises to keep them in the mindset that everything they want in life is possible. It’s important to keep their energy high and hopeful. The exercises include my famous Three Questions:

Question 1 – I want you to imagine that you are financially secure, that you have enough money to take care of your needs, now and in the future. The question is…how would you live your life? Would you change anything? Let yourself go. Don’t hold back on your dreams. Describe a life that is complete, that is richly yours.

Question 2 – This time you visit your doctor who tells you that you have only 5 – 10 years left to live. The good part is that you won’t ever feel sick. The bad news is that you will have no notice of the moment of your death. What will you do in the time you have remaining to live? Will you change your life and how will you do it?

Question 3 – This time your doctor shocks you with the news that you have only one day left to live. Notice what feelings arise as you confront your very real mortality. Ask yourself: What did I miss? Who did I not get to be? What did I not get to do?

Vision

In their next meeting, the financial life planner reviews the exercises with their client in a way that allows the client to feel the importance of their responses, even experiencing emotion around what they want in life. The client trusts their financial planner enough to welcome questions about those aspirations, which leads to more excitement to deliver their financial plans.

The planner will take all these wonderful longings that their client has expressed and paint a picture of their future. We call it “lighting the torch.” It’s a moving experience and can take training and practice for a financial planner to deliver effectively but when done well, the client is on fire! In fact, often by the next meeting, the client has already made huge strides toward achieving goals that they previously thought were impossible.

Obstacles

The next meeting focuses on perceived challenges to realizing the client’s life plan. It’s key for the planner to serve as a guide and the client to be the expert on how to overcome any obstacles. Out of this meeting comes a clear path forward and a client full of excitement to implement their plan.

Knowledge & Execution

After holding these three life planning sessions, the planner can confidently design a financial plan that centers on the client’s life, one that the client is eager to fulfill. How many financial planners tell you that at the end of their meetings, their clients are excited about implementing their financial plan? The truth is most of the clients aren’t. They do it as a matter of course, but the clients of financial life planners are excited about implementing the plan because it’s going to deliver them into the life that they’ve always wanted to live.

Now imagine you are that financial life planner.

I would like to know more.