February 16, 2021

Important points from the Budget 2021 for your clients

Nitesh Buddhadev

Nimit Consultancy

India had varied expectations from Budget 2021 ranging from Covid Cess, increase in capital gains tax to wealth tax. However, Ms. Sitharaman on Feb 01, 2021, delivered a booster budget.

No negative changes in form of an increase in tax rates, levy of surcharges, and cess were observed which was a big relief to the taxpayers. The major changes in budget 2021 for an individual taxpayer are explained below.

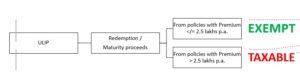

1. Unit Linked Insurance Plan (ULIP)

Under the existing Income Tax laws, proceeds from ULIP were exempt – no conditions applied. Under the proposed changes in budget 2021, redemption/maturity proceeds from ULIP policies issued on or after Feb 01, 2021, with a premium > 2.5 lakhs are brought under the tax gamut.

In case of multiple policies, the aggregate premium should be considered for comparing with Rs 2.5 lakhs.

In case of death of the ULIP holder, the above conditions are not applicable and proceeds from ULIP shall be exempt.

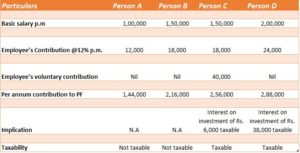

2. Employees’ Provident Fund

Under the erstwhile IT laws, interest on EPF was always exempt. The proposed changes in Budget 2021 bring under the taxation gamut income from investments in provident funds, relatable to investments exceeding Rs 2.5 lakh a year i.e. if an employee contributes more than Rs 2.5 lakhs p.a. in the provident fund (including voluntary contributions) the interest on such investments exceeding 2.5 lakhs is taxable.

Let’s understand by a simple example:

In absence of voluntary contributions, employees with basic salary above Rs 1,73,611 per month will get impacted by this change. Such changes will implement w.e.f April 01, 2021.

3. Debt markets

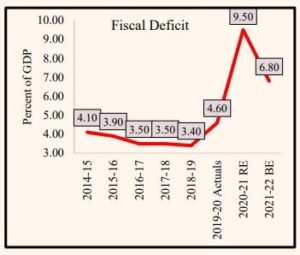

The fiscal deficit estimate for 2020-21 at 9.5 percent of GDP which is higher than revised estimates and the fiscal deficit estimate for 2021-22 is 6.8 percent of GDP which is higher than market expectations.

This higher government spending will be met by additional borrowings of Rs 80,000 crore from the market this fiscal year and Rs 12.06 lakh crore in 2021-22. This will lead to supply pressure in the bond market and cause interest rates to move higher in the coming years.

Proposal for development of a permanent institutional framework to buy investment-grade debt securities in stressed and normal times will help in the development of the bond market and will also bring down the liquidity and credit premiums and thus cost of capital for borrowers.

4. Gold

The customs duty on gold has been reduced from 12.5% to 7.5%. This will make Gold an attractive investment option as it will decrease the Gold price for new investors. However, the decrease in custom duty has been partially set off by a freshly introduced levy called the ‘Agriculture Infrastructure and Development Cess of 2.5%.

The creation of a spot gold exchange regulated by SEBI has also been brought by the Finance Bill 2021.

5. Ease of tax compliance

The tax return filing process has been simplified by bringing in 3 major changes:

- In addition to salary income, bank accounts, tax payments, and TDS details, pre-filled income-tax returns will now also include details of capital gains from listed securities, dividend income, interest from banks, post office etc.

- Taxpayers will not be required to estimate their dividend income while making advance tax payments. This will save payment of interest by taxpayers due to underestimation while paying advance taxes. Investors would have to consider dividend income for advance tax only after they receive it.

- Individuals above 75 years of age don’t need to file returns if they have income only from pension and interest on fixed deposit accruing in the same bank where the pension is deposited. Hence, this exemption would not apply to people with multiple bank accounts. The exemption is only for filing tax returns, not for paying tax. Bank will deduct the income tax which he has to pay and deposit to the government.

6. Other changes

- The budget has extended the eligibility window for the additional deduction of Rs 1.5 lakh for home loans taken for affordable housing under Sec 80EEA by another year. This benefit is only for first-time homebuyers. This exemption is available for loans up to Rs. 35 lakhs for houses worth up to Rs. 45 lakhs. There are also restrictions on the house size (60 sq. m in metros and 90 sq. m in other towns and cities).

- Erstwhile, the time limit for filing delayed/revised ITR was end of the Assessment Year i.e. for the financial year ended March 31, 2020 (Assessment Year 2020-21) delayed/revised return could be filed up to March 31, 2021. Under the proposed changes, the time limit for filing delayed (belated) / revised income-tax return is reduced by 3 months (i.e.for Assessment Year 2021-22 delayed/revised return can be filed up to December 31, 2021).

- The time window for reopening of ITR in some cases has been reduced from 6 years to 3 years now.

Explained in very simple way with illustration. Thank you

NICE SIR THANKS