April 27, 2021

Interest rates and their bitter-sweet connection to debt fund performance

Piyush Gupta

Director, CRISIL Research

Debt funds have received increasing attention from individual investors in recent years given the market-linked returns, liquidity, tax benefits and transparency that they offer, and which make these more lucrative compared with traditional fixed investment products such as bank deposits.

Between December 2016 and December 2020, assets of individual investors (including retail and high networth individuals (HNIs)) in the category, has jumped nearly 50% from Rs 3.13 lakh crore to Rs 4.65 lakh crore[1].

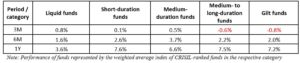

What these investors need to keep in mind, however, is that like their equity peers, debt funds too are capital market instruments and therefore prone to short-term volatility. A case in point is the negative returns in some categories of debt funds in the latest 3-month period, as the following table shows.

Point to point performance of debt funds as on March 31, 2021

Unraveling the recent volatility

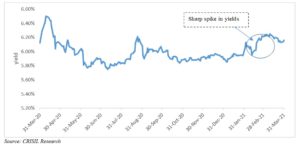

The recent volatility seen in long maturity debt funds is primarily an outcome of the sharp spike in yields in the last quarter (see chart below), which pressured bond prices and, in turn, adversely affected the performance of the funds.

The spike in yields was primarily due to wider-than-expected fiscal deficit estimates in the Union Budget 2021-22. To fund the incremental deficit, the government announced an additional borrowing of Rs. 80,000 crore in fiscal 2021 and a higher gross borrowing of Rs. 12,06,000 crore in fiscal 2022. Higher supply of government securities (G-secs), rising US Treasury yields and an increase in crude oil price pushed up the domestic yields.

As mentioned earlier, debt mutual funds are exposed to capital market vulnerabilities and thus have their ups and downs. One of the factors that influence the performance of debt funds is interest rate. For instance, long-duration debt funds with higher maturity perform well when interest rates fall, while funds that follow accrual strategies to minimise interest rate risk do well when the rates remain flat or are high.

Movement of 10-year G-sec yield

Not a one-off event

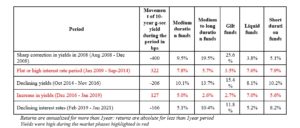

Debt mutual fund investors should note that such volatilities happen across market cycles and they do have an impact on returns. For instance, during the Global Financial Crisis of 2008, interest rates fell steeply, pulling down the yields. As a result, longer duration funds, such as gilt funds and medium- to long-duration funds, soared. Between December 2016 and January 2019, when the yields were up, shorter maturity funds came up trumps.

Market phase analysis

Imperative for investors

As seen in the analysis above, debt mutual funds are prone to volatility on account of interest rate movement. Hence, it is important to understand the risk associated with interest rate movements across debt fund categories and take appropriate steps to mitigate the associated anxiety.

The volatility in the performance of fund categories varies and so, investors should be aware of the risks associated with each category. Shorter duration funds by design have lower interest rate risk than longer duration funds. An analysis of distribution of returns across categories of funds also shows that higher the investment horizon, lower are the chances for investors to generate negative or below normal returns.

Methodology

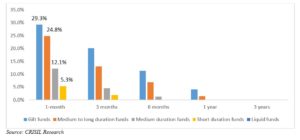

CRISIL analysed the number of times liquid, short-duration, medium-duration, medium- to -duration and gilt funds gave negative returns across short and long duration of rolling periods for the past 15 years ended March 31, 2021.

The fund categories have been represented by weighted average index created from CRISIL-ranked mutual fund schemes in the respective category.

While the rolling periods considered are 1 month, 3 months, 6 months, 1 year and 3 years, the analysis has been carried out on a daily basis, thus increasing the number of observations over the period of analysis.

The analysis shows that long duration debt categories, such as gilt and medium- to long-duration funds have witnessed negative returns 25-29% of times in the 1-month rolling period. However, as we increased the investment horizon, the percentage of loss instances decreased, and a 3-year daily rolling analysis showed that gilt funds gave negative returns only a fraction of time while all other categories ended with positive performance.

Historic analysis of negative returns (less than zero) in major debt mutual fund categories

Tax benefit: Holding period of more than three years in debt funds also provide investors with indexation benefit, thus increasing their take home money compared with traditional debt instruments such as bank fixed deposits.

Thus, it is imperative that investors become aware of various debt mutual funds’ sensitivity to interest rate movements and accordingly map their portfolio planning with the right fund category. It is also important to review portfolio at regular frequency and as and when market condition changes. This is crucial to successful financial planning. Apart from these, investors should also analyse the overall impact on their costs and taxation.

Lastly, interest rates are just one of the factors that impact debt mutual funds. There are other risks such as credit and concentration of the portfolio. Financial advisors should factor in all such risks while identifying the right kind of funds for their customers.

[1]As per data disclosed by the Association of Mutual funds in India (AMFI)

Very insightful