February 15, 2022

Post-Retirement Options in NPS

Ravinder Singh Chawla

Founder and Managing Partner, RSC Skillbuilding and Consulting Solutions LLP

National Pension System (NPS) is one of the best solutions for voluntary retirement planning. It fulfills all the checkboxes, be it from a regulatory perspective, expense ratios, tax benefits, returns, or flexibilities. It is an irony that the NPS’ awareness level amongst the citizens is very low, despite the Retail NPS scheme has been in existence since 2009.

NPS has two different types of accounts: Tier 1 and Tier II. While Tier 1 is primarily and mandatory Retirement Planning account, Tier 2 is a voluntary savings and investment account. We shall be focussing on Tier 1 of NPS.

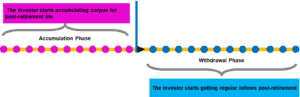

As is well known, there are following two important stages in retirement planning.

1) Accumulation Phase:

This is also referred to as Deferment of annuities. This is where the investor accumulates corpus for retirement while actively engaged in an occupation, be it a salaried profession or business or farming or any other occupation.

Let’s take the case of an investor named Ravi Mathur (30), who works as a Sr. Manager in a company. He plans to retire at the age of 58. He is investing Rs. 10,000 every month in NPS Tier 1 towards his retirement planning for the next 28 years. This is an example of the accumulation stage.

2) Withdrawal Stage:

This is also referred to as the Encashment phase or Immediate Annuities’ phase. This starts from the time the investor, post-retirement, wishes to get regular streams of income. As in the example cited above, once Ravi Mathur retires at the age of 58, he would want regular streams of income (through annuities) to be available to him and his spouse, for the remaining period of their post-retirement lives. This is an example of the withdrawal or encashment phase.

There is still, relatively speaking, a lot of awareness about the important aspects of the accumulation phase of NPS Tier-1 in terms of the following:

- Types of available asset classes options: Equity, Corporate Bonds, Govt. Securities and Alternate

- Asset-allocation choices: Auto and Active

- The seven Pension Fund Managers (PFMs)

- Tax benefits in Tier 1: Deductions u/s 80 (CCD1), 80(CCD1B) and 80(CCD2) *

*80(CCD2) deductions towards contributions for salaried individuals working in companies that have subscribed to Corporate NPS. - Very low scheme expense ratio

It is the post-retirement aspect of the NPS Tier 1 that not many people are aware of. This article is intended to discuss the options available in the Withdrawal phase of retirement planning through NPS.

Exit options in NPS Tier 1

Let’s understand this with the example of Shreyas Shinde, who is retiring from his company (a PSU) at the age of 60. He has accumulated a corpus of Rs. 3 Crore in NPS Tier 1. He is eligible to withdraw 60% of the corpus (Rs. 1.8 Crores) in lump-sum, exempt from taxes. The balance of 40% (Rs. 1.2 Crores) could be used to purchase annuities.

What if Shreyas had retired before attaining the age of 60? In that case, he could have withdrawn only 20% of the corpus (Rs. 60 Lakhs) as a tax-free amount. He would have had to purchase annuities from the balance 80% (Rs. 2.4 Crores) amount.

Let’s now look at who are the annuity service providers, the classification of annuity options, and the types of actual annuity scheme options available to the subscriber, post-retirement.

Annuity Service Providers

There are a total of 13 Annuity Service Providers (ASPs) in NPS, all of them being leading Life Insurance companies. The subscriber could choose to get annuities from any one of them, basis the annuity quotes received from them.

The ASPs are as follows:

- LIC of India

- HDFC Life Insurance Co. Ltd.

- ICICI Prudential Life Insurance Co. Ltd.

- SBI Life Insurance Co. Ltd.

- Bajaj Allianz Life Insurance Co. Ltd.

- Kotak Mahindra Life Insurance Co. Ltd.

- Max Life Insurance Co. Ltd.

- Tata AIA Life Insurance Co. Ltd.

- PNB Metlife India Insurance Co. Ltd.

- Edelweiss Tokio Life Insurance Co. Ltd.

- Star Union Dai-ichi Life Insurance Co. Ltd.

- India First Life Insurance Co. Ltd

- Canara HSBC Oriental Bank of Commerce Life Insurance Co. Ltd.

Classification of annuity options

Annuities are a stream of payments. Pensions are always in the form of annuities. The annuities could be classified in different ways. Before understanding the annuity scheme options under NPS, let us understand this classification that could be done in four ways:

i) Periodicity of annuity payments

ii) Duration of annuity payments

iii) Whether the purchase price would be returned to the nominee or not

iv) Whether the annuity is fixed or inflation-linked.

i) How often is an annuity paid?

The annuity payments could be made as opted for by the annuitant. It could be monthly, quarterly half-yearly or yearly, as opted for by the client

ii) Duration or Term of the annuity payment:

Following are the options that the annuitant could choose from:

- Life Annuity with or without return of purchase price.

- Joint Life Annuity with or without return of purchase price.

- Family income with the return of purchase price.

- Annuity for a certain duration or till the Life of the annuitant.

iii) Whether the purchase price would be returned to the nominee of the annuitant or not:

There are two options for the annuitants to choose from. In the case of the ‘with return of purchase price’ (with ROP) option, the annuities are lower as the corpus paid to buy the annuities get returned to the nominee of the annuitant(s), upon death. However, in the case of ‘without return of purchase price’ option (without ROP) option, though, the annuity amount is higher as the annuities cease upon the death of the annuitant(s) and no amount is payable thereafter.

iv) Whether the annuity is fixed or inflation-linked

Again, this depends on the choice made by the client. Normally, the annuity amounts remain fixed, throughout the term. However, if the annuitant wants it to be rising with a certain rate towards inflation, it could be so.

Annuity options in NPS Tier 1 scheme

As already discussed, once the subscriber wishes to exit the scheme (it could be extended till the age of 75 in case desired so by the subscriber), the balance amount (40% or 80%…depending upon the age at exit) of the corpus needs to be utilized for getting annuities. This is what is referred to as the purchase price.

Following are the seven options that the subscriber could choose from:

1) Life Annuity with Return of Purchase Price (with ROP): The subscriber gets annuities till life and upon his / her death, the purchase price is paid to the nominee.

2) Joint Life Annuity with Return of Purchase Price (with ROP): The subscriber gets annuities till life and upon his / her death, the annuities get paid to the spouse till her / his life. Upon the death of the last survivor, the purchase price is paid to the nominee.

3) Life Annuity without Return of Purchase Price (without ROP): The subscriber gets annuities till life and upon his / her death, the annuities cease and nothing is payable thereafter.

4) Joint Life Annuity with ROP: The subscriber gets annuities till life and upon his / her death, the annuities get paid to the spouse till her / his life. Upon the death of the last survivor, the annuities cease and nothing is payable thereafter.

5) NPS – Family income with ROP: The subscriber gets annuities till life and upon his / her death, the annuities get paid to the spouse till her / his life. On the death of the spouse, the annuities get paid to the dependent mother of the subscriber and thereafter to the dependent father of the subscriber, till their life. Upon the death of the last survivor, the purchase price is paid to the nominee.

6) Life and Certain Annuity: In this option, the annuities get paid for 5/10/15/20 years, as desired by the subscriber or till the subscriber survives, whichever is later.

7) Annuities rising @ 3% p.a: The annuity amount keeps rising at the rate of 3% every year, to provide for some impact towards inflation.

How can the subscriber compare the annuity quotes?

The subscriber could log into https://cra-nsdl.com/CRAOnline/aspQuote.html and get a quote from different ASPs towards different options and choose the one that suits him/her.

The USP of the annuity option

With rising longevity, a retiree may live beyond 90 years of age. While the subscriber may be able to manage the retirement corpus on his / her own at the time of retirement, he/ she may not be able to do it beyond a certain age. Annuities, however, would ensure a certain stream of regular income, irrespective of the rate of interest prevalent at that time. This would help the clients cushion themselves against the reinvestment risk.

Even if the clients feel confident about the ability to manage their money themselves, it is important if the clients are advised to consider allocating a certain portion of their retirement corpus towards annuities. NPS is indeed an option worth considering for Retirement Planning.

Sir, awesomeesome detailed information you have shared in this article.. Thank you

Nice detailed article. Missing out on the NPS drawbacks:

1. 40% corpus doesn’t come back to the investor

2. Annuity rates are abysmally low

3. Annuity is taxable

Hi Aniruddha,

Thanks for your feedback.

The article does attempt to point out the other perspective to the notion of perceived disadvantages. You may read the article again pl.!

Similarly, you may visit the link given in the article and check out the annuity quotes to see for yourself that the annuities are indeed quite competitive.