December 29, 2020

Should you make your client invest internationally?

Neil Parikh

CEO, PPFAS Mutual Fund

We are currently grappling with a global pandemic of colossal proportions. Job losses, business closures, and high mortality rates have wrecked the social and economic landscape in varying degrees worldwide. Investors are seeking to hedge against such uncertain times by shedding their ‘home-bias and avidly seeking to add foreign stocks to their portfolio. With no specific country emerging as that ‘one safe-harbour’, investors are eagerly embracing the advantages accorded by geographical diversification (especially in the form of stocks listed in developed countries such as the USA).

While this trend has been more vivid over the past six months, it has been gathering momentum over the past few years. This has been catalyzed by the launch of more international investment products, and the fact that some foreign markets and marquee technology stocks have been on a tear.

So… is international investing a fad or is there something more to it? While I would steer clear of predicting about what the future holds, here are a few reasons why I unhesitatingly vouch for international investing and believe it should be practiced by all investors:

- Nothing is permanent:

While it is true that in the long-run, stocks usually move higher, it is also true that stock markets are cyclical. What goes up today may come down tomorrow. Also, the more popular a market gets, the frothier it becomes. Hence, concentrating all our investments in one market is not prudent, especially in today’s times when it is fairly easy to invest globally via mutual funds.

- Country Risk’ can bite you:

Most equity mutual fund schemes help investors diversify across industries within the same country. However, investors could still be affected if there are negative events throughout the country (such as war, drought, political turmoil etc.). Investing across countries helps to reduce this risk.

- India is only a sliver on the global scene:

India’s market-capitalization is under 3% of the global number. Hence, by ignoring the rest of the universe, we could be missing out on several opportunities.

- Markets do not always move in tandem:

While it may seem that all markets rise and fall together, it is not always so. Certain local factors affect every market, and the stocks listed therein. This leads to periods of huge divergence between markets.

Source: Bloomberg

- Reducing portfolio volatility:

All stock markets do not always move at the same pace or in the same direction. Hence, investing across countries helps to reduce the volatility of the portfolio. Lower fluctuations in the Net Asset Value ((NAV) mean greater peace of mind…

- Local markets may lack variety:

There are several world-class companies which do not have Indian subsidiaries who are listed (Eg. Coca Cola, Nike, Samsung). Also, there are innovative companies making certain products/services for which there are no Indian substitutes. When a Fund invests abroad, its investors get a chance to benefit from the performance of such global leaders.

For instance, the Indian stock market does not offer too many options to an investor seeking to invest in software product companies or pharmaceutical innovator companies. However, the US market offers a choice of many such names. Hence, global diversification offers an opportunity to own such companies.

- Valuations matter too:

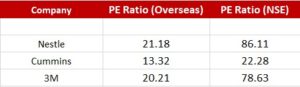

Surprisingly, a domestic subsidiary’s Parent company may be available at a more attractive valuation abroad.

A representative sample is provided here:

*Source: Bloomberg | Illustrative Purposes only | December 3, 2020

In such a case, investors could diversify simply by purchasing the Company abroad. Also, in many cases, the Parent earns royalty from its foreign subsidiaries, and by owning the parent one could benefit from this.

Of course, the risks to international investing cannot be overlooked. These include:

- Currency:

Currency fluctuations can wreak returns, but this risk can be managed by hedging the foreign component of the portfolio. Also, given that the rupee is always trading at a premium to the US Dollar in the Forward market, such hedging can actually enhance returns (Currently 5-6 % per annum).

- Overwhelming choice:

Given the vast choice available, it is imperative that one not get too adventurous or excited, and stick to countries / markets / companies within the realm of one’s understanding and which are liquid enough so that one can transact seamlessly.

To sum up, in an increasingly globalized world, one’s investments also need to be increasingly global. Mutual Funds offer the most transparent, tax-efficient and cost-effective way to gain such exposure.

===============================================================================

Disclaimer: Views mentioned in the article and the author’s personal views.

Leave a Reply