Network FP Thinktank is an Online Professional Journal by Network FP wherein we share the articles written by top-class financial advisors and industry thought leaders from across India and the world.

The KRIS Model – A Rapport and Influence Building System

Jigar Parekh

Director at Anchoredge

July 26, 2016

Reading Time: 7 minutes Jigar Parekh is the Head-Training at Prudent CAS Ltd. Jigar did his Masters in Finance and is a CFP by profession. He has more than 10 years of experience in the industry. He believes that the role of financial planner in the life of his/her client is more of friend, philosopher and guide rather than just creating the plan. The actual job of a financial planner only begins once the plan is prepared and implemented.

The most important quality of any successful financial advisor is always the effective communication. And to effectively communicate we must realize that we are all different in the way we perceive the world and use that understanding as a guide to our communication to others. We all human beings are same yet different. Read the below article to find out how one can make such difficulty an opportunity by applying the KRIS Formula of Jigar Parekh !

Read MoreHow to Build a Strong Network of Referral Partners – by Vivek Shah

Vivek Shah

Founder & CEO, Finrise Financial Planners

July 21, 2016

Reading Time: 5 minutes Mr. Vivek Shah is a practicing Financial Planner and is Certified Financial Planner from FPSB India. After completing his graduation in commerce, he pursued Master’s in Business Management in Finance. He also holds master’s in commerce (M.Com) and C.A.( Int). He is a Life Planning practitioner trained from Kinder Institute of Life Planning (USA).

In this article, Network FP ProMember Vivek Shah shares his insights on financial advisors can generate referrals by building a strong network of “Referral Partners” which will support sustainability and growth of practice over the longer run.

Read MoreCan you read an entire book in an hour? How to read a Mind Map?

Yogin Sabnis

VSK Financial Consultancy Services Pvt. Ltd.

July 14, 2016

Reading Time: < 1 minute Yogin Sabnis laid the first stone for VSK Financial Consultancy Services Pvt Ltd in 1985. He is a Certified Financial Planner and certified for Seven Stages of Money Maturity by Kinder Institute of Life Planning. His rich experience of more than 30 years with VSK has revolved around providing financial advice and execution services to residents as well as non residents, of varying age groups and social strata.

Recently, Network FP invited Yogin, a Network FP ProMember and an avid Mind Mapper, to take a session on Mind Maps at one of our monthly Masterclasses. Yogin obliged the invite and his Mind Mapping for Financial Planning was very well received by the fraternity. Here, he showcases how one can re-visit an entire book in 30 to 60 minutes. You don’t want to miss this one for sure.

Read MoreWhy Advisors shouldn’t ignore the HUF?

Anup Bansal

Co-founder and Managing Director, Mitraz Financial

July 12, 2016

Reading Time: 3 minutes Anup Bansal, a CFA by profession is the Co-Founder & MD of Mitraz Financial Services Pvt Ltd. Anup has over 15 years of work experience and is a Network FP ProMember. Anup and his team recently bagged The Wisest Advisor Award at the 7th Annual Wealth Forum Platinum Circle Advisors Conference. We congratulate Mitraz Team for this achievement.

In this article, Mitraz’s team shares its insights on the Hindu Undivided Family (HUF). While HUF is not something new to the advisory fraternity, this piece should surely be a good quick recap of the benefits of HUF to your clients. Read the below to know how HUF structure could be put to effective use by your clients to save taxes. As a Financial Advisor, you might want to make your clients aware of HUF and even help them create and manage it.

Which MF Transaction Platform is best for you? A Review by Gajendra Kothari

Gajendra Kothari

MD & CEO, Etica Wealth Management Pvt Ltd

June 23, 2016

Reading Time: 6 minutes Mr. Gajendra Kothari is Managing Director & CEO of Etica Wealth Management Pvt Ltd. Mr Kothari is a CFA Charterholder. He has also done MBA from International Management Institute, New Delhi. He has more than 11 years of experience encompassing both Indian and overseas capital markets. He is a regular columnist for Mint Newspaper under the column title “The Intelligent Investor”. He has also been felicitated the Wealthforum Rising Star Award 2013.

Here, Mr. Kothari, a Network FP ProMember shares his experience working with the different MF transactions platforms available and reviews them for the benefit of our readers. Read the below review to know which platform would best suit your practice for ease of doing business.

Read MoreSabbatical Planning – How can advisors help their clients with this New Age Goal?

Prasad Chitre

Chief Financial Life Planner at Clover Solutions

June 21, 2016

Reading Time: 6 minutes Mr. Prasad Chitre is Chief Financial Life Planner at Clover Solutions. He has more than 15 years of work experience in Personal Finance and is a Network FP ProMember. He has also completed the Foundation course in Life Planning by The Kinder Institute of Life Planning. He specialises in Sabbatical Planning and here he shares with us the how, what and why of Sabbatical Planning.

The practice of sabbatical has entered the commercial world in the few years, with major employers such as IBM, Intel, Microsoft, Goldman Sachs, McDonalds, Xerox, Nike, Wells Fargo and American Express offering sabbatical leave programs. Read the below article to know how financial advisors can help their clients seeking a sabbatical i.e. a long break from work.

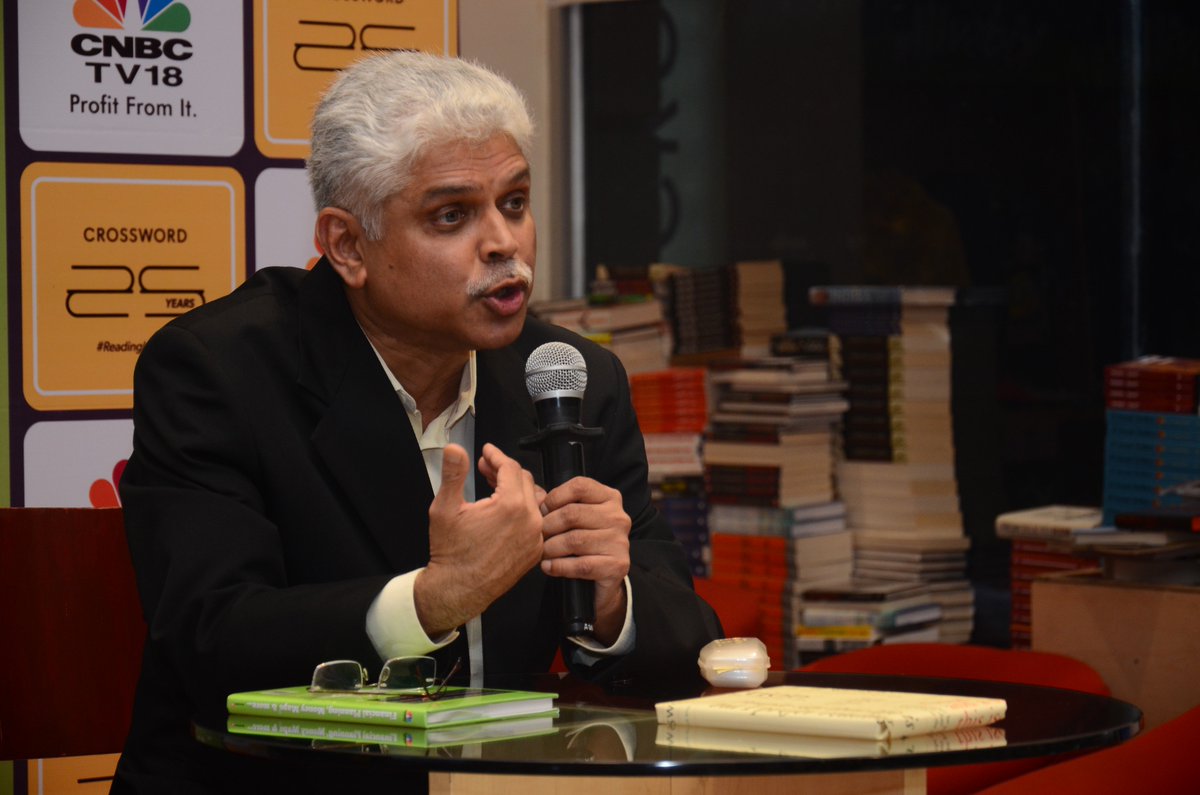

Read MoreGaurav Mashruwala’s Yogic Wealth-The Wealth that Gives Bliss!!

Gaurav Mashruwala

Financial Planner, Author, Speaker, Columnist

May 12, 2016

Reading Time: 7 minutes India’s renowned Financial Planner Gaurav Mashruwala’s book Yogic Wealth has been well received by readers as well as the financial advisory fraternity. Written in small chapters and with ample examples, the author drawing his learnings from ancient scriptures gives a very fresh & interesting perspective on people’s behaviour and relationship with money. After the successful run of English edition, the publishers have also released the Gujarati edition.

We requested Mr. Mashruwala to share couple of extracts from the book for Network FP’s readers to which he kindly consented. Below are 2 extracts from the book Yogic Wealth. I throughly enjoyed reading the book. Hope you enjoy reading it too.

Read MoreKrishna Impact – The Easiest Way to Communicate the Importance of Hiring an Advisor

Jigar Parekh

Director at Anchoredge

March 17, 2015

Reading Time: 7 minutes Story telling is known to be one of the most effective way to grab attention, engage your audience and convey difficult messages. The Alpha added by Advisers is not something that many investors get easily. To help the investors come out of this ‘Unknown’ situation, Advisers can leverage classical stories and engage prospects on how they can better win the money game, with the right adviser on their side.

The best players in the world need a coach. So why not you, Mr. Investor? Let’s go explain this to our clients with the Krishna Impact

Read MoreDownload Income Tax Calculator FY 2015-16 in Excel (India)

Sadique Neelgund

February 28, 2015

Reading Time: < 1 minute Download and check out our popular Income Tax Calculator FY 2015-16 in Excel which incorporates the recent changes in Indian Union Budget 2015.

Read MoreThe 5 Pillars of Advisory Technology

Sadique Neelgund

January 7, 2015

Reading Time: 6 minutes Getting clients is not difficult but delivering consistently with a quality standards can be a challenge unless we have setup a technology enabled framework. Managing growth is an issue that most IFAs face but is also an under focused area. Given the market dynamics, regulatory framework and early phase of advisory model in India, many of us prefer to grow in an incremental manner. So this means we don’t design for growth, we take it as and when it comes. Having an integrated view of your business with technology included can significantly be a winning point, in the long term. In this article, Faizal Bag, Managing Director at Pulse Labs Research & Technology Solution gives a Bird’s Eye view of pillars of advisory profession and suggests to look at different models of integrating technology platforms.

Read MoreCategories

- Advisory Processes (2)

- Client Acquisition (1)

- Client Retention (3)

- Client Servicing (3)

- Financial Advisors Community (1)

- Financial Products (1)

- Foundations (7)

- Needs & Solutions (6)

- NFP Thinktank (280)

- Technology Adoption (3)

- Uncategorized (85)